The statute of limitations is understood as the time period during which one of the conflicting parties has the right to apply to the courts in order to protect their interests. In relation to individual labor disputes, it has been increased since January 2021. The article discusses the current rules for determining the statute of limitations for collecting wages, as well as the grounds and procedure for its restoration.

Legal regulation

The relationship between employer and employee is regulated by the Labor Code of the Russian Federation. It was adopted after the signing of No. 197-FZ, which dates back to December 30, 2001. The current version of the Labor Code of the Russian Federation came into force on April 24 of this year.

The limitation period for individual labor disputes is determined by two articles of the code. The first one is Art. 386 - establishes the time period given to the employee to apply to the labor dispute commission created at the enterprise (abbreviated as CTS). Second – Art. 392 – regulates a similar possibility for filing a claim in the courts.

What is the beginning of the calculation period?

This is the start of the clock to file a claim. Art. 392 of the Labor Code of the Russian Federation designates this moment as the date when a person realized that his rights were violated. For example, for salary payments, one year is counted from the date of expected payment of funds.

When a person is fired, one month is counted from the date of delivery of the work book or order.

Problems arise with determining the day when the employee learned that his rights were violated. It is impossible to say one hundred percent when an employee learned about a violation of his rights based on wages or other grounds.

The reference date does not include the moment of receipt of information from other specialists. The judiciary accepts facts as guidelines. Wage arrears begin to be counted from the day when the funds were supposed to be transferred. The duration is counted from the date of dismissal from the company.

Practice shows that most disagreements arise over the collection of wages, bonuses, and other sums of money.

There is no consensus on when to start calculus. Collection is made from the date when the plaintiff realized that his interests were violated. This is the day of payment of remuneration or the day of delay in transfer.

In non-payment of remuneration and other cases, judges associate the starting point with various circumstances.

Calculation rules

The statute of limitations for cases of collection of unaccrued or unpaid wages when applying to the CCC is three months, and when filing a statement of claim in court - one year. The countdown of time begins from the moment when the employee received or should have received information about a violation of his labor rights.

It should be noted that a similar period of three months is provided for applying to the CCC for any type of labor dispute. The situation with a lawsuit is somewhat different. The employee is given a year only for disputes over wages and equivalent payments, for example, compensation for vacation or other similar payments. The statute of limitations for starting legal proceedings in conflicts of a different nature is much shorter:

- You can challenge your dismissal within a month;

- Three months are given to file a claim for other disputes.

Important . Until the beginning of 2021, a similar three-month period applied to disputes regarding the collection of wages. Its changes in the direction of increase - 4 times at once - are rightly considered beneficial for employees.

Statute of limitations for collecting wages

Article 392.

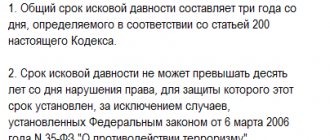

Time limits for going to court for resolution of an individual labor dispute [Labor Code of the Russian Federation] [Chapter 60] [Article 392] The employer has the right to go to court in disputes about compensation by the employee for damage caused to the employer within one year from the date of discovery of the damage caused. The general limitation period is three years from the date determined in accordance with Article 200 of this Code.

However, you should keep in mind that the period of limitation is not automatically calculated from the moment of excessively accrued salary, since according to Article 200 of the Civil Code of the Russian Federation: Unless otherwise established by law, the limitation period begins from the day when the person learned or should have find out about a violation of your right and who is the proper defendant in a claim to protect this right.

Overpayment may

Details about the limitation period for labor disputes regarding the recovery of wages

For all these and other questions, we recommend contacting the portal’s specialists. Consultations are provided 24 hours a day and free of charge. To ask a question, use the online form or leave your phone number.

In accordance with the Labor legislation of the Russian Federation, the employer must make a full settlement with the employee no later than on the day of dismissal.

Calculation of limitation periods for labor disputes

In labor legislation in Art.

392 of the Labor Code of the Russian Federation establishes special deadlines for going to court to protect one’s labor rights (the statute of limitations).

According to Article 392 of the Labor Code of the Russian Federation, an employee has the right to go to court to resolve an individual labor dispute: 1) within three months from the day he learned or should have learned about a violation of his right; 2) within one month from the date of delivery of a copy of the dismissal order to him or from the date of issue of the work book. The courts associate the beginning of the limitation period with the following circumstances: 1.

We recommend reading: Loan secured by a house

Whether the employment relationship with the employee has been terminated or not, whether wages have been accrued to him, whether the relationship is ongoing.

Non-payment of wages 2019

Wages are an indispensable element of labor relations.

Wages include the following payments: Specific terms for payment of wages are established by the labor and (or) collective labor agreement. For example, an employer pays an advance for the first half of the month on the 20th, then the basic salary should have been paid no later than the 5th of the next month.

Limitation periods for wages

These changes were introduced by Federal Law No. 272 (dated October 3, 2021).

The law stipulates that the employer is obliged to pay each employee a salary no later than 15 calendar days after the end of the period of work for which this money is accrued.

EXAMPLE. A citizen receives a salary on May 10 for the period of his work from April 16 to April 30.

Accordingly, if he receives funds more than 15 days after April 30 (for example, May 16), this will be a violation for which he can go to court.

What is the statute of limitations for collecting wages?

Employees (including former ones) can recover unpaid wages by contacting the labor dispute commission (hereinafter referred to as the LCC) or the court.

However, this can only be done within the period specified by the Labor Code: Judicial statutes of limitations for other types of disputes are much shorter:

- upon dismissal - 1 month from the day the employee was issued a work book or a copy of the dismissal order;

- in other cases - 3 months from the moment the employee learned (should have known) about the violation of his rights.

This is important, since often, in addition to the demand for payment of wages, other claims are made in court - for example, to declare the dismissal illegal. They may be rejected due to the expiration of the period for filing a lawsuit.

Previously, the period for collecting wages was 3 months.

At the end of 2021 it was increased to a year.

From October 3, 2021, the statute of limitations for labor disputes over wages will be 1 year

Document: Federal Law of July 3, 2021 No. 272-FZ.

Until October 3, 2021, an employee had the right to go to court to resolve an individual labor dispute within three months. The increase in the limitation period for wage disputes for up to 1 year is one of the most large-scale and significant changes since the Labor Code of the Russian Federation came into force.

Statute of limitations on payments upon dismissal

Hello!

In this case, you need to go to court and demand arrears of wages, late fees, and compensation for moral damages.

And then with a writ of execution - to the bailiffs.

You can write complaints to the labor inspectorate and the prosecutor's office about violations of your labor rights; these bodies can hold the manager administratively liable and punish you with a fine, but whether this will help you get your money back is not a fact.

In accordance with Article 84.1 of the Labor Code of the Russian Federation, this position is set out in the Letter of the Federal Service for Labor and Employment dated December 24, 2007.

N 5277-6-1: Consequently, the actions of your employer are illegal; he is obliged to make all payments to you before you go on vacation. You have the right to go to court to recover unpaid wages, penalties, as well as compensation for moral damage. Olga, you most likely missed the statute of limitations on the dispute over the payment of wages.

Law Club Conference

2.

Will the employer “fight back” by referring to Article 392 of the Labor Code from the point of view of the fact that for the eighth month - yes, please, but for the rest the employee missed the 3-month deadline?

The employer may claim that the deadline was missed, but this will be decided by the court, which may decide in favor of the employee or vice versa.

The employee has the right to appeal the court decision.

The message was edited by Feniks55: 09 October 2010 - 08:45 I am a lawyer myself, but due to the specifics of my activity I am far from labor law, that’s why I ask people who might have had such a specific legal situation. The only question remains regarding the PRACTICAL application of the 3-month period. It has been 3 years since I found out that my salary was not paid. In court, the employer did not have a 3-month period.

The judge directly told them that now if three months have passed, then they won’t pay any salary at all?

Source: //152-zakon.ru/srok-davnosti-vzyskanija-vyplat-zarabotnoj-platy-12444/

Peculiarities of presenting claims for the collection of wages by current employees

The procedure for asserting rights by employees with whom the employment relationship has not been terminated deserves special mention. This category of employees has the opportunity to file a lawsuit at any time without restrictions.

In fact, there is no statute of limitations for such labor disputes. The legality of this approach was confirmed by the Plenum of the RF Armed Forces in Resolution No. 1 adopted on March 17, 2004 (clause 56). Over the past 16 years since the publication of the document, courts of various instances have made a large number of decisions in favor of the plaintiffs.

How to win an argument

The current legislation quite actively protects the employee, giving him the opportunity to influence in different ways the situation when the employer does not pay wages, changes its size unilaterally, or otherwise violates labor laws. True, not everyone knows what they should do in practice. In such a situation, an experienced lawyer can help.

So, the employer often tries to cling to any opportunity not to pay compensation to the former employee. And there are often references to the fact that the statute of limitations for labor disputes regarding the recovery of wages has expired. Let us remind you that this implies a period within which the employee has the right to go to court.

And if non-payment of wages is combined with illegal dismissal, then the employer can appeal to the fact that the latter is appealed within a month from the date of receipt of the relevant order. The date of issue of the work book is also taken into account for the countdown. A transfer with which the employee does not agree can be protested in accordance with the Labor Code of the Russian Federation within 3 months.

However, based on current legislation (the data is current at the beginning of 2021), a dismissed employee has the right to go to court within a year after he was supposed to be paid off. And since the issuance of all money is made on the same day when the employment relationship is terminated, and the corresponding contract is considered terminated, then the statute of limitations must be calculated based on this date.

Please note that we are talking about a year, and not about 3 months, as it was before. This innovation came into force on October 3, 2021. All courts have been notified about this, so there should be no violations of rights by the latter. But if someone still refers to outdated norms, you can simply contact a lawyer to clarify the situation (or point out the relevant changes).

We suggest you read: If your wife starts talking about divorce

There are different circumstances in life. For example, an employee quit, but was unable to come to collect the salary he was entitled to in person (he got sick, that is, for a good reason). When he finally ended up at the enterprise, he learned that the settlement with him was made in a smaller amount than expected. In this case, the limitation period must be counted from the corresponding date.

Sometimes an employee is given a bonus or compensation, but is not informed of the issued orders. In such a situation, the limitation period for the specified payments begins for him from the day when this became known. What can be proven by testimony (for example, if former colleagues told him) or by providing the court with relevant correspondence.

Participation in legal proceedings requires patience and perseverance. The judge will not believe the words, so evidence must be collected in advance.

2 recommendations on what to do if you miss a deadline:

- Use as a bargaining chip evidence that the employer has acknowledged its obligations.

If the company admits its debt, and there are documents about this, then the period is renewed. For example, an employee wrote a letter demanding payment of funds. The company sent a response letter indicating the day of payment, but did not fulfill its obligations. It turns out that the company has recognized its obligations, which means there is a reason to resume the calculation of time.

- Do not focus the judge’s attention on missing a deadline. If the defendant does not declare that time has passed, then there is a chance for a successful outcome of the case.

Tactics “forward” do not always give the desired results. Therefore, it is better to use cunning to achieve your goal. You can get a document confirming the recognition of the debt in a roundabout way. To do this, tell the accounting department that a certificate of the amount of debt is required to approve a loan from the bank. If the company provides a certificate, it thereby acknowledges the existence of its obligations. Check that the document bears the date of issue and the company seal.

If the money is not paid, you have to go to court. The main thing is not to miss twelve months so that the judge does not reject the claim. If the money must be paid on May 25, 2017, then the claim must be submitted no later than May 25, 2018.

In addition to the remuneration itself, interest must also be collected. The penalty is calculated in the amount of 1/150 of the refinancing rate established by the Central Bank of the Russian Federation. It is also possible to compensate for moral damage, on the basis of Art. 237 Labor Code of the Russian Federation. Practice shows that the amounts of moral damage are often reduced. So you shouldn’t hope for excessively large compensation.

The time for legal protection is counting down from the day following the date of delay until the day of payment.

Specific terms for payment of wages are established by the labor and (or) collective labor agreement.

The legislator leaves no choice to the employer and indicates the need to pay wages at least every half month. According to amendments to Article 136 of the Labor Code of the Russian Federation, from October 2021, specific payment days are set no later than 15 calendar days from the day the period for calculating payments expired.

For example, an employer pays an advance for the first half of the month on the 20th, then the basic salary should have been paid no later than the 5th of the next month.

The above terms apply to all components of the salary.

Payment of wages is the direct responsibility of the employer. Violation of the terms and conditions of payments entails civil liability.

The minimum amount of monetary compensation is established by Article 236 of the Labor Code of the Russian Federation and is 1/150 of the key rate of the Bank of Russia, which is in effect at this time.

10,000 rubles (debt amount) x 1/150 x 9% (key rate of the Central Bank of the Russian Federation) x 30 days (delay period) = 180 rubles (compensation for delayed payments).

The maximum amount of compensation by law is left at the discretion of the parties to the labor relationship and can be fixed in the employment contract or local regulations of the employer.

Payment of compensation must be made on the day the salary is paid. The obligation of such payment is not affected by the circumstances that contributed to its occurrence. That is, the presence or absence of the employer’s fault is not taken into account.

If the employer refuses to pay compensation for delayed wages, the employee has the right to demand it in court.

For the employer, this threatens with additional costs in the form of compensation for moral damage and legal expenses (lawyer services for preparing the necessary documents and/or representing the employee’s interests in court). Also, by court decision, the established amount of state duty is collected from the employer, from which the employee is exempted.

The optimal action of an employee in the event of a situation in which the employer evades the obligation to pay wages on time is to submit a reasoned claim.

Often it serves as an effective way to achieve the expected result.

We invite you to familiarize yourself with: Deadlines for submitting an application to cancel a court order

The form and content of such a claim are not provided for by law, nor is it mandatory to forward it to pay off the debt or apply to the district court.

This tool, in some cases, serves as a good lever for the employer to voluntarily fulfill his obligation, both in terms of payment of the accrued amount of debt and disputed unpaid amounts.

The claim indicates the details of the parties to the employment relationship, the essence of the requirements (payment of debt, compensation), the grounds on which the employer violates your rights (links to articles of the Labor Code of the Russian Federation), the justification for the amount of debt and compensation (calculation), as well as the very essence of the claim (pleading part ).

The employee sets the deadline for considering such a claim independently, taking into account the financial situation of both parties.

A claim for recovery of wages must meet the requirements of the Civil Procedure Code of the Russian Federation, in particular Articles 131 and 132.

What should you pay attention to when filing a claim for recovery of wages?

- Determination of jurisdiction of the dispute. Current legislation establishes it at the location of the legal address of the defendant or at the place of execution of the employment contract. Moreover, such a place must be fixed in the employment contract. For example, the employment contract indicates the city, street and house in which the workplace is located.

- Calculate and indicate the amount of the claim price. The calculation may be incorrect or inaccurate. However, this is not a basis for leaving the claim without progress.

- Indicate the circumstances of the dispute and references to the norms that the employer violated.

- Correctly write the claims in the pleading part of the claim.

- Be sure to sign the statement of claim, indicating your name and date.

- In the appendix to the claim, indicate the required number of copies of documents (according to the number of participants in the civil case). Attach a calculation of the requirements and evidence in the case.

Failure to comply with one of the requirements imposed by law entails procedural consequences in the form of leaving the statement of claim without progress or returning the claim to the applicant. If such circumstances occur, the plaintiff must ensure compliance with the relevant court requirements.

In addition, compliance with all the requirements of the law does not guarantee the unreasonable abandonment of the claim (return of the claim) by the court. In this case, the court's ruling is subject to appeal.

To collect unpaid wages, the Labor Code of the Russian Federation establishes an increased deadline for filing a claim in court compared to other individual labor disputes.

Within one year, the employee has the right to file a claim against the employer to recover unpaid wages.

This period is not preemptive, and the consequences of missing it are applied by the court only if the defendant files a corresponding petition. In this case, the plaintiff has the right to petition for the restoration of the missed deadline for valid reasons.

The petition to restore the missed deadline for filing a claim in court for the recovery of unpaid wages is considered by the court individually. The court takes into account all available circumstances, since the list of valid reasons is not limited by law.

What to do if the statute of limitations has expired?

The expiration of the statute of limitations does not mean the employee loses the right to appeal to the CCC or court. The rules of work of the labor dispute commission established by the Labor Code of the Russian Federation provide this body with the opportunity to restore the deadline and consider the conflict situation on its merits. To do this, it is enough that the reasons for missing time to contact the employee are recognized as valid.

The court is also obliged to accept the employee’s statement of claim and open a case, within the framework of which the issue of the statute of limitations is considered. The decision made is based on two factors. The first is the presence of a statement from the employer about the expiration of the statute of limitations, and the second is the reasons for the delay and the employee’s petition for its reinstatement.

If the employer does not submit the specified document, the court considers the case in the general manner. If there is an application from the employer, which happens most often, the reasons for the delay are first examined. They must be indicated in the petition to restore the statute of limitations filed by the employee.

If the petition is not completed, there is a high probability of refusal to satisfy the claim. If the document is drawn up accordingly and found to be justified, the period is restored, after which the case is considered on its merits in the usual manner.

Wage debts in 2021 – in case of bankruptcy of an enterprise, statute of limitations

Non-payment of wages by employers is one of the grossest violations of the law, but it is also one of the most frequent.

If wages are greatly delayed or not paid at all, then there is no need to delay resolving the issue.

General points

Many experts recommend starting with a direct contact with the employer.

Don't wait until you've accumulated several months' salary in debt. Even if the funds are delayed for 3-5 days, you should contact your employer in writing with a corresponding statement. It is better if it is collective.

Perhaps the situation can be resolved through negotiations. It would be nice if at this step you can involve the owners of the organization in solving the problem.

It is they who often seek additional funds and provide them for urgent repayment of salary debts.

The management of an enterprise sometimes finds itself in a rather problematic situation due to external factors that have caused non-payment of wages.

If you can’t reach an agreement within a reasonable time and get your money, then it makes sense to start preparing for various methods of collecting wages.

Experts recommend taking the first steps in this direction if payment is delayed for a period of 15 days or more.

Comment. Sometimes you can find recommendations to stop working if wages are not paid for more than 15 days, warning the employer about this step in advance.

But it all depends on the situation. In some enterprises, such actions of even a few employees can lead to huge accidents and damage.

As a result, the situation will only become more complicated, because resuming work will require new financial costs for repairs.

Current legislature

Before you begin to deal with wage debt or prepare an application to court to force its collection, you must study Article 136 of the Labor Code of the Russian Federation.

It explains the main points about the procedure and rules for the payment of wages to employees by the employer. Don't forget about the Constitution of the Russian Federation.

What you need to know

According to the law, every citizen who has an official job must receive wages at least 2 times a month. The employer can pay it more often, but not less often.

In case of late payments, wage arrears arise.

This will be a direct violation of the legislation in force in the Russian Federation and the labor rights of employees, regardless of the reason for the delay.

An employee, if he does not receive his wages on time, can go to court, the labor inspectorate, etc.

He can demand from the employing organization not only to pay the due amount of wages, but also for compensation.

The amount of compensation may vary, but will not be less than 1/300 of the key rate of the Central Bank of the Russian Federation for each day of delay.

For disputes regarding the payment of wages, the statute of limitations is set at 1 year. It must be observed in order to avoid problems when collecting wage debts.

If the statute of limitations has expired

The statute of limitations applies only if the employer declares this in court.

If such an application is not received from him, then the court will consider the case in full and the employee can count on receiving the entire amount due to him.

It would be useful to pay attention to the position of the RF Armed Forces, which the court hearing the case will certainly listen to.

According to the Supreme Court of the Russian Federation, if an employee continues to work for the same employer, then the violation becomes a continuing violation.

This means that the statute of limitations will only count for employees who have already been dismissed. If the dismissal has not been formalized, then the employer will not be able to apply the statute of limitations.

Even if more than a year has passed since the dismissal, there is still a chance to restore the statute of limitations.

If the delay in submitting documents to the court occurred for a valid reason, then at the request of the employee it will be reinstated.

Typically, suitable grounds for reinstating the term may include long-term illness of the employee, etc. reasons. But only if you have supporting documents.

In case of bankruptcy of an enterprise

One of the most difficult situations is the collection of wages in the event of bankruptcy of an enterprise.

Debts to personnel are included in the register of creditors and are in the second priority for payment.

But the question of whether there will be enough to pay off wage debts after the sale remains open.

If there is not enough money in the bankruptcy estate, it will be proportionally divided among all second-priority creditors, including employees.

Comment. Often, when an enterprise goes bankrupt, the property turns out to be taken “off the balance sheet” a long time ago, that is, it is registered in the name of other companies or individuals.

In this case, the possibility of paying off debts will directly depend on the actions of the appointed manager and their effectiveness.

To protect their interests, the team can choose a representative who will participate in the meeting of creditors and interact with the appointed manager.

Current wages are paid in the event of bankruptcy of an enterprise from the bankruptcy estate out of turn. 2 months before dismissal, the external manager must warn the employee.

Only after their expiration will an order be issued and workers will be dismissed due to bankruptcy.

If desired, the employee can resign before the expiration of this period of time, receiving severance pay in the amount of wages before the expected date of dismissal.

How to collect wage debt from an employer

If negotiations with representatives of the employer did not lead to results, then you need to start taking action without delay.

The employee can try to solve the situation in two ways:

- Applying to court with a statement of claim.

- Sending applications to various inspection and control authorities (prosecutor's office, labor inspectorate, etc.).

Each of these options has its pros and cons. You can try to act first through supervisory and regulatory authorities, and only then go to court if there is no success. Or you can immediately go to court with a claim.

Procedure for going to court

Collection of wages through the court is the most effective method, but it is also the most difficult.

You will need to prepare a statement of claim and submit it. After this, it will be necessary to wait for consideration and a decision on it.

Only after the court decision has entered into legal force will it be possible to resort to collecting wages through bailiffs or transferring a writ of execution to the bank serving a specific organization.

When going to court, special attention should be paid to the statement of claim. It is best to seek help in drafting it from professional lawyers.

But if for some reason this is impossible, then you can do it yourself.

In the latter case, it is best to use a ready-made sample, which can be downloaded here, and modify it for a specific situation.

It is quite possible to file a claim for recovery of wages on your own; the main thing is to be patient.

A statement of claim is filed with the district court at the location (registration) of the organization.

Required documents

When filing a claim for recovery of wages, one statement will not be enough. The employee must prove with the help of documents all the facts and circumstances cited in the claim.

Let's consider what documents can be attached as evidence:

- employment contract;

- The order of acceptance to work;

- certificate of tariff scale and average earnings;

- certificate of accrual (not accrual) of payments in favor of the employee;

- other documents.

Most of these documents are usually not at the employee's disposal. To receive them, you need to submit a corresponding application to your employer.

If it is ignored, then you can try to claim them through the court.

: how to repay a debt

Alternative Methods

The effectiveness of contacting the prosecutor's office and/or labor inspectorate is always different. Sometimes the issue can be resolved in a matter of days, or even hours, using this method.

But more often the problem will take at least 10-30 days to solve, and there will be no special result, except for an additional fine for the organization or an order issued.

The prosecutor's office, labor inspectorate and other government agencies do not deal with issues of non-payment of wages if there is a dispute about the amounts between the employee and the employer. In this case, it is better to immediately go to court.

Wage arrears still occur in Russia, even at fairly large enterprises. They are formed for various reasons.

But the employee should not leave the situation to its own devices. It is imperative to take steps to resolve it.

Source: //yurday.ru/dolgi-po-zarplate/

Grounds for restoration

As noted above, both the CCC and the judicial authority have the right to restore the expired period for filing a claim in disputes regarding the collection of arrears of wages. To do this, the reasons for missing the time given to contact any of the specified bodies must be recognized as valid.

These, in accordance with the provisions of the Labor Code and Resolution No. 2 of the Plenum of the Armed Forces of the Russian Federation, include:

- employee's stay on a business trip;

- force majeure circumstances;

- disease;

- the need to care for a relative with a serious illness.

The above list is not exhaustive. It can be expanded, but for this the employee must prove two facts:

- the objective nature of the circumstances;

- their clear connection with their own personality.

The best option for the employee is to support the text of the petition with documentary evidence. For example, being on a business trip is confirmed by a travel certificate, the presence of a disease in yourself or a relative is confirmed by a sick leave certificate or a certificate from a medical institution. An alternative form of evidence is the testimony of one, or preferably several, people.

Important . The absence of documentary evidence or the provision of documentation with false information practically guarantees the refusal of the application and the inability of the employee to defend his rights in court.

The following grounds for filing a petition to restore the statute of limitations are not considered valid:

- the employee’s appeal to other regulatory or supervisory authorities, for example, the labor inspectorate or the prosecutor’s office, as well as waiting for a response from them;

- payment of wages by the employer, occurring on a periodic basis and irregularly;

- the employee lacks information about the wages due to him or other payments equivalent to it;

- appeal to a judicial body whose functions do not include consideration of the case, and other similar circumstances.

Important . The current practice of considering cases by courts shows that it is not always possible to prove the presence of good reasons and restore the deadline for filing a claim. In most cases, the judge refuses the plaintiff. All the more seriously one should take the correct execution of the relevant petition and support it with documentary evidence.

How does the law protect workers' right to wages?

Collection of wages is a kind of dispute between the owner of the enterprise and the employee. The subject of this conflict situation is monetary remuneration that was not paid to the employee on time for one reason or another. In addition, for violations of the payment deadline, compensation is provided for delayed wages, which currently amounts to 1/150 of the refinancing rate for each day of delay.

Labor legislation has determined the following cases of mandatory receipt of wages:

- money that was accrued by the company but not paid to the employee;

- collection of funds for the period of inactivity;

- receiving wages in the event of a person’s absence from work for valid reasons (you can find out a list of these from a lawyer);

- compensation for unused vacation or unpaid sick leave;

- penalties for late payment of wages on time;

- collection of earned funds due to bankruptcy or liquidation of an enterprise.

Where to contact

The statement of claim, regardless of the amount of debt, is filed with the district court at the location of the employer. But, if we talk about the jurisdiction of labor disputes regarding the collection of wages, the plaintiff is also allowed to file a claim at the location of the branch or separate division of the organization where he worked.

IMPORTANT!

If wage arrears do not exceed 500 thousand rubles, the employee has the right to use the debt collection procedure on the basis of a court order issued by a magistrate at the location of the employer. But the employer has the right to challenge this order, and then all issues will have to be resolved in court.

Changes in legislation: what else do you need to keep in mind?

In general, the concept of a statute of limitations applies to something completed. For example, an employee was supposed to receive a salary, but this did not happen, and his relationship with the employer was interrupted. Likewise for other problems. If the employment contract is still valid, the individual continues to work for the company or individual entrepreneur, and the management does not pay wages in the present or for the past period, then in this case the victim retains the full right to go to court or other authorities in any moment.

That is, a continued offense does not have a statute of limitations, or rather, this concept simply cannot be applied to it. This rule is due to the fact that the situation is still ongoing, it continues to remain relevant in the present. Therefore, any employer’s claims for missing a deadline will be considered invalid.

The statute of limitations does not apply even when there is no dispute as such between the employee and the company’s management. If the company does not deny the very fact of debt, but explains the delay or non-payment by a lack of finances and (or) opportunities, for example, seizure of accounts, then in this case its employee has the right to apply for a court order. And then the issues related to the statute of limitations lose their relevance.

Please note that the new statute of limitations applies to cases where an employee filed a lawsuit after October 3, 2016. If the salary delay occurred before, and the employee has already been fired, then there is a chance to receive compensation, but only if the plaintiff can prove the existence of good reasons, and also if the company itself does not file a corresponding petition.

In addition, an employee has the right to go to court if he continues to work for a company that has not paid him wages for the past period, including for the past year (or even years). In such a situation, the continuing offense rule applies.

Collecting wages from an employer - advice and assistance from a labor law lawyer

At Legal, you can get free advice and professional assistance from a lawyer on labor law. In this article we will focus on certain aspects of labor law. From the provisions of Art. Art. 22 and 129 of the Labor Code of the Russian Federation it follows that wages (employee remuneration) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal conditions, work in special climatic conditions and in areas exposed to radioactive contamination, other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). It is the employer's responsibility to pay the full amount of wages due to employees. According to Art. 135 of the Labor Code of the Russian Federation, an employee’s salary is established by an employment contract in accordance with the remuneration systems in force in a given organization. Remuneration systems, including tariff rates, salaries (official salaries), additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, systems of additional payments and incentive allowances and bonus systems, are established by collective agreements, agreements, local regulatory acts in accordance with labor legislation and other regulatory legal acts containing labor law norms. Despite the transparency of the above-mentioned provisions of the Labor Code of the Russian Federation, as well as the presence of extensive judicial practice and the practice of the State Tax Inspectorate, disputes about the collection of wages are not decreasing. On the contrary, their number, as well as the diversity of the subjects of the claim and the evidence used by the parties, are increasing. Let us consider these disputes by subgroups. Collection of a constant part of wages The types under consideration include disputes regarding the collection of the main component of wages - the tariff rate, salary. Moreover, they can be divided into two subtypes: - collection of accrued but unpaid wages; — collection of unaccrued wages. Collection of accrued but unpaid wages This category of cases differs from others in its indisputability. Almost all cases end in satisfying the employee's demands. The most common cause of disputes in this category is the difficult financial condition of the enterprise and, as a consequence, the formation of wage arrears to employees. What should an employer do in this situation? It is advisable to prevent such a dispute. “Winning” in court is highly doubtful. In most cases, the employee has pay slips in his hands, which indicate when and in what amount his wages were accrued. However, the payment of these amounts does not actually occur - the money is not transferred to the employee’s bank account, nor is it issued from the company’s cash desk. You should keep in mind the explanations given in paragraph 56 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation.” When considering a case brought by an employee, whose employment relationship has not been terminated, for the recovery of accrued but unpaid wages, it should be taken into account that the employer’s statement that the employee missed the deadline for filing a lawsuit in itself cannot serve as a basis for refusing to satisfy the claim, since in this case the deadline for going to court has not been missed (the violation is of a continuing nature). Therefore, the employer’s obligation to timely and fully pay the employee wages, and even more so the delayed amounts, remains throughout the entire period of validity of the employment contract. Arbitrage practice. The employee filed a lawsuit against the municipal unitary enterprise for the recovery of accrued but unpaid wages. According to him, the employer has arrears of wages to him, accumulated over three months, because does not pay wages on time. At the time of filing the claim, the plaintiff's wage arrears were not repaid. The defendant did not object to the satisfaction of the claims and presented a certificate from which it followed that there really was a debt. Guided by the provisions of Art. 136 of the Labor Code of the Russian Federation, establishing the procedure, place and timing of payment of wages, taking into account the obligation imposed by labor legislation on the employer to pay the employee, the court satisfied the claims (Decision of the Melenkovsky District Court in case No. 2-816 for 2011). Collection of unaccrued wages This type of dispute differs from the previous one in that there is a dispute between the parties over the amounts of payment, and not just over the fact of non-payment. For example, an employee believes that when paying for a controversial type of work, one calculation method should be used, but the employer calculates payment according to other prices and tariffs. Accordingly, the first one believes that he was not accrued or did not receive additional wages, and therefore goes to court. Arbitrage practice. The employee filed a lawsuit against the employer for the recovery of unaccrued wages and payment for downtime due to the employer’s fault. In the statement of claim he indicated that he worked as a machine operator and was paid at piece rates. From April 2010 to November 2010, in addition to his main work, he was entrusted with performing work that was paid on a time basis (tractor repair, collecting firewood, etc.). In total, they worked 600 hours in such work. However, they were paid less than expected. Believes that work during the specified period should be paid in accordance with the requirements of Art. 150 of the Labor Code of the Russian Federation: when, taking into account the nature of production, workers with piecework wages are entrusted with performing work that is charged below the categories assigned to them, the employer is obliged to pay them the inter-category difference. In this case, such a difference, according to the plaintiff, is 37,920 rubles. The court found that remuneration at the enterprise was made on the basis of the regulations on the remuneration of managers, chief specialists, and employees, for whom tariffs were established depending on the category and hourly tariff rates of piece workers. Based on these tariffs, the court independently calculated the plaintiff’s wages for all types of work during the disputed period. In accordance with these calculations, the plaintiff was not credited 622 rubles for the disputed period. 73 kopecks, and not the amount indicated by the plaintiff. The court, accepting this calculation, proceeded from the provisions of Part 2 of Art. 150 of the Labor Code of the Russian Federation, the plaintiff’s references to Part 3 of Art. 150 of the Labor Code of the Russian Federation was considered unfounded, since in this case the plaintiff did not perform work below the category assigned to him, but performed work of varying qualifications. Based on the foregoing, the court decided to satisfy the claims partially, in the amount determined by the court (Decision of the Inzensky District Court of the Ulyanovsk Region dated January 12, 2011 in case No. 2-8/2011). If we analyze similar court cases, we can conclude that refusals of employees to satisfy demands for the collection of a permanent part of wages are mainly associated with: - the erroneous opinion of the employee regarding both the amount of the employer’s debt to him and the fact of the existence of such debt; - with the employee missing the deadline to go to court and the court applying, at the request of the defendant, the consequences of such an omission. Collection of “northern” bonuses Article 146 of the Labor Code of the Russian Federation guarantees increased wages for workers employed in work in areas with special climatic conditions. According to Art. 315 of the Labor Code of the Russian Federation, wages in the regions of the Far North and equivalent areas are carried out using regional coefficients and percentage increases in wages. Most disputes about the collection of “northern” allowances are based on the parties’ incorrect interpretation of the law. The employee believes that wages should be calculated and paid using one coefficient, while the employer, meanwhile, applies a different coefficient. According to Art. 316 Labor Code of the Russian Federation, Art. 10 of the Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” (hereinafter referred to as the Law of the Russian Federation of February 19, 1993 N 4520-1) the size of the regional coefficient and the procedure for its application for calculating wages of employees of organizations located in the regions of the Far North and equivalent areas are established by the Government of the Russian Federation. State authorities of the constituent entities of the Russian Federation and local governments have the right, at the expense of funds from the budgets of the constituent entities of the Russian Federation and the budgets of municipalities, respectively, to establish higher regional coefficients for institutions financed from the budgets of the constituent entities of the Russian Federation or municipal budgets. A regulatory legal act of a constituent entity of the Russian Federation may establish a limit on the increase in the regional coefficient established by the municipalities included in the constituent entity of the Russian Federation. At present, the Government of the Russian Federation has not adopted a normative act establishing the size of the coefficients for persons working in the Far North and equivalent areas. Based on the “fuzzy” legal framework of regulation, disputes arise regarding the payment of “northern” bonuses. Arbitrage practice. The employee filed a lawsuit against the employer to recover the under-accrued regional coefficient, indexation of the amount taking into account price inflation, and interest for late payment of the under-accrued regional coefficient. In support of the claim, she indicated that she was fired due to a reduction in the number of employees. During the work period, until March 2005, the employer paid the regional coefficient in the amount of 1.6, and in March 2005, the coefficient was reduced to 1.4 for all employees. At the end of January 2011, the plaintiff learned from the company’s continuing employees that when they received wages for January, the regional coefficient was 1.6. The employee believed that her rights were violated by the employer’s calculation and payment of wages without taking into account the regional coefficient of 1.6. In this connection, in her opinion, the employer should have paid wages for the period of work with a regional coefficient of 1.6. The court examined the current rules of law and local regulations of the employer and came to the conclusion that the plaintiff’s demands were unfounded. At the same time, he indicated that the employer is a commercial organization that has the ability to pay wages to its employees only from profits and does not apply to enterprises, institutions or organizations financed from the budgets of constituent entities of the Russian Federation. Therefore, the obligation to pay the regional coefficient, that is, the established state guarantee for persons working in the regions of the Far North and equivalent areas, rests with the defendant within its minimum limits, namely in the amount of 1.4%, since this coefficient was established by the authorities state power of the USSR and continues to operate for non-production workers. At the same time, the employer has the right to independently increase the size of the regional coefficient compared to the established minimum due to the fact that any improvement in the employee’s situation, including an increase in the size of the components of wages, does not contradict the current labor legislation and the interests of the employee. Having established that the employer did not make such an increase and the coefficient was calculated within the limit established by law, the court found no grounds for satisfying the demands of the former employee (Decision of the Yuzhno-Sakhalin City Court of the Sakhalin Region dated June 17, 2011 in case No. 2-2779/2011). Arbitrage practice. The employee’s dispute with the OJSC over similar demands had the same result. This time the refusal was justified by the plaintiff missing the statute of limitations, and the dispute was left without consideration on the merits. Refusing due to the expiration of the statute of limitations, the court noted that all employees, when receiving wages, also received pay slips, which showed what size of the “northern” coefficient the employer applied. Consequently, the employee in 2005 and in subsequent years knew about the applied coefficient and could go to court with the corresponding requirements. The court did not establish the validity of missing the statute of limitations (Decision of the Yuzhno-Sakhalin City Court dated May 23, 2011, Cassation ruling of the judicial panel for civil cases of the Sakhalin Regional Court dated August 30, 2011 in case No. 33-2427/2011). In the case discussed below, the recovery of additional accruals of the “northern” coefficient was refused even with the continuation of the employment relationship. Arbitrage practice. The employee filed a lawsuit against the employer. From 2005 to 2010 the calculation of the district coefficient to wages was made in the amount of 1.3, which the plaintiff believes is illegal and contrary to the decision of the executive committee, which set the coefficient in the given region at 1.7. The plaintiff did not consider the deadline for going to court to be missed, since she had recently learned about the violation of her right to receive a larger salary. She asked to oblige the defendant to make an additional payment to the plaintiff’s wages for work in an area equated to the regions of the Far North, using a regional coefficient of 1.7 for the time she worked in the specified period. The court, refusing to satisfy the claims, indicated that the starting date for calculating the limitation period is the receipt by the employee of pay slips (which reflect the components of wages and types of accruals). From them, the employee learned about the size of the applied “northern” coefficient (Decision of the Ust-Kutsk City Court of the Irkutsk Region dated June 16, 2011, Determination of the Judicial Collegium for Civil Cases of the Irkutsk Regional Court dated September 13, 2011 in case No. 33-9752-11). As practice shows, refusals to employees to satisfy demands for the collection of “northern” allowances are associated with an incorrect interpretation of the provisions of regulatory legal acts, as well as with the court’s application of the consequences of an employee missing the statute of limitations for the above-mentioned requirements (in disputes about recovery for previous years). Collection of premiums Premium in accordance with Art. 135 of the Labor Code of the Russian Federation may or may not be a component of wages. The court's decision directly depends on this factor. If a bonus is established by an employment and/or collective agreement, local regulations (for example, regulations on remuneration or bonuses), its components and the basis for accrual are transparent, understandable and stable, the likelihood of collecting such a bonus from the employer in favor of the employee is very high. If the bonus is not established by any documents and is a one-time remuneration to a specific employee, the court almost never recognizes its payment as an obligation of the employer towards the employee. When the payment of a bonus is provided for only by part of the employer’s documents, and even more so in the form of references to other local regulations of the enterprise, the court examines each case thoroughly and makes a decision depending on the established circumstances of the particular case. Disputes regarding the collection of bonuses are typical both during the period of ongoing employment relations and after the dismissal of an employee. Moreover, the second case occurs more often than the first. Arbitrage practice. The former employee filed a lawsuit for the recovery of bonuses based on the results of 2010, as well as a monthly bonus for January 2011. In support of the claim, she indicated that until 02/03/2011 she worked for the defendant at 0.5 times the rate. On the day of termination of the employment contract, the wages due to her were not paid in full. The court found that the bonus based on the results of work in 2010 was not paid to all employees of the enterprise due to poor economic performance, which does not contradict the company’s internal documents regulating bonuses. The employment contract with the plaintiff stipulates that, in addition to the official salary, she is given a bonus of 50% based on the results of business activities; the amount of the bonus can be reduced for poor quality work in accordance with the bonus regulations. The facts of the plaintiff’s violation of her professional duties in January 2011 were confirmed by an internal memo from her manager and other evidence in the case. The employee was not punished for these violations, which, according to the court, does not contradict the norms of the Labor Code of the Russian Federation. Bringing disciplinary action against an employee based on these facts is the right, and not the obligation, of the employer (Article 192 of the Labor Code of the Russian Federation). At the same time, the employer’s refusal of the right to impose a disciplinary sanction is not a basis for not applying other measures of influence to the employee, in particular in the form of deprivation of bonuses. Based on the above, the court refused to satisfy the claims (Decision of the Gornomarisky District Court). The correctness of the court decision was also confirmed by a higher court. As a rule, refusals of employees to satisfy claims for the collection of bonuses are associated with the establishment of their lack of right to demand payment of the requested bonus. Opinion. Alevtina Kalitovskaya, senior legal consultant at Profile LLC Based on my experience, I can say that disputes over the collection of wages most often involve incentive payments. The reason for disputes, as a rule, is that employers do not comply with the procedure for their implementation and the rules for determining their sizes. The fact is that the decision on the establishment of remuneration systems falls within the competence of the employer, which means that the conditions for incentive payments are left to them. Thus, if the employer in the Regulation on remuneration (or any other local act) enshrines the payments of the stimulating nature for the achievement of certain indicators, then when the employee is achieved by the employee, he is obliged to pay them. What is far from always done. And since most of the conflicts affecting the incentive payments to employees, the court resolves based on the norms of local acts and conditions enshrined in labor and collective agreements, when adopting the relevant acts, the personnel department should be specially thorough to formulate all points of the Regulation. In practice, two options are possible. The first - the indicators are not clearly defined, so the employee can be quite difficult to prove their achievement. But in this case, there is a risk that it will be difficult for the employer to prove their unattion by the employee. The second option is to fix in a local act not only types of payments, but also to fix their specific sizes, as well as indicators on the basis of which the issue of establishing them will be decided individually. I will dwell on several important points that employers should pay attention to when setting a reward. Firstly, if the local regulatory act provides for additional payments in favor of the employee, then the employer is obliged to make them on the conditions that they are established. Let's say, in the absence of restrictions for the payment of additional remuneration, according to the results of the year, the employer must pay it to the employee in full. Secondly, if the bonus depends on certain indicators, then the employee has the right to a bonus when reaching them. If you fix in the local regulatory act a set of premium indicators, indicating that the bonus will be paid only if all of the listed points are performed, then you can not accrue the bonus to the employee who did not fulfill one indicator from the list and all together. The obligation to pay a bonus arises from the employer only if the employee fulfills all these indicators. Thirdly, the employer should be fixed in the local regulatory act. The provision on depriving the employee of the incentive payment for violation, for example, labor discipline, even if such a violation did not affect the implementation of production indicators and on the result of labor. Then the employer will be able to not pay or reduce the size of the bonus following the results of the organization for the year. Fourth, it should be remembered: if the employee temporarily acts on another position, then the employer needs to pay not only the difference in salaries between the actual position of the employee and the one that he occupies temporarily, but also all the allowances and bonuses that are established in local regulatory acts for this temporary position. The recovery of wages upon dismissal this category of disputes is assigned to a separate type in connection with their special characteristics: they lie outside of labor relations. Most conflicts concerns the recovery: - wage arrears formed during the period of work; - final calculation upon dismissal; - reimbursement of earnings during the delay in issuing a work book. It should be noted that all these disputes may end in a refusal to the employee to recover on the basis of passing the deadline for him to apply to the court. It is quite difficult for the employee to comply with a three -month period according to these requirements established by Art. 392 Labor Code of the Russian Federation. And the point is not even in diseases or business trips, but in ordinary sluggishness. Since the employer almost always declares the application of the consequences of missing the statute of limitations (in the presence of such a circumstance), the court refuses the employees to satisfy the claim on this basis, without considering the dispute on the merits. Arbitrage practice. The employee filed a lawsuit with a lawsuit against the recovery of wage arrears and non -pecuniary damage. In the period from 01.04.2006 to 05/04/2008 he worked for the defendant. Upon dismissal, he was not paid wages. Due to the fact that the defendant did not pay him wages for a long time, he experienced moral and physical suffering, and therefore asked to recover and compensate for non -pecuniary damage. LLC announced the application of the consequences of passing the limitation period for applying to the court. The court established the passage of the statute of limitations and checked the lack of good reasons for its pass, refusing the lawsuit for the specified circumstance (the decision of the Gubakhinsky City Court of the Perm Territory dated 10/28/2010, the cassation ruling of the Judicial Collegium for Civil Cases of the Perm Regional Court dated 02.12.2010 in case No. 33 -10537). It should be noted that the argument of the employees that the claim for the collection of wages is a three -month period provided for in Art. 392 of the Labor Code of the Russian Federation, does not apply, based on the incorrect interpretation of substantive law. As the courts indicate, in Art. 395 of the Labor Code of the Russian Federation established a rule according to which the justified monetary requirements of employees are subject to satisfaction in full. Thus, the right of the employee to receive monetary amounts cannot be limited by the deadline. Labor legislation does not contain any restrictions regarding the amount of satisfied monetary amounts for the past time addressed to the employer. The period of time in respect of which the employee raises the question of the payment of monetary amounts does not matter. The only restriction that may affect the amount of satisfied monetary claims is the application of the statute of limitations at the request of the employer. Thus, if, when considering the dispute, the court found out that in terms of the claims, the deadline for applying to the court expired, but by others - no, the court in the first part applies the consequences of passing the deadline (refuses the claim), and according to the second - considers the case on the merits . Refusals to employees to recover (completely or in part) may also be dictated by the fact that in fact the employer does not have arrears to the employee or there, but in a smaller amount than it was stated. In the latter case, the court evaluates evidence and makes its own calculation, satisfying the requirements of the employee based on this calculation. Arbitrage practice. The dismissed employee filed a lawsuit with a claim for the recovery of wages, compensation for non -pecuniary damage, issuing a copy of the employment contract. In the justification of the lawsuit, she indicated that she worked for the defendant as a seamstress with piecework wages. Until the case of consideration in court, she was not paid wages for November 2010. The plaintiff appealed to the court with the requirements for the recovery of wages in the established Art. 392 of the Labor Code of the Russian Federation is a three -month period, however, the court found that the claims must be partially satisfied. At the hearing, it was established that the parties did not conclude a written employment contract, the plaintiff was actually allowed to work as the director. Under these circumstances, the employer does not have the opportunity to issue a copy of the employment contract to the plaintiff, since he was not consistent with the parties, and the court refused to satisfy the requirements for the employer to issue a copy of the employment contract. The court found that the plaintiff worked in normal working hours: a five -day working week with two days off. From the analysis of the working calendar and the time of time, the court found that in November the plaintiff worked out the established number of working days. The parties do not dispute that in accordance with Art. 131 of the Labor Code of the Russian Federation, part of the wages for November, the plaintiff, at her own free will, received goods. In connection with these circumstances, the court recovered from the defendant only the established part of the wage arrears, since the validity of the rest of the plaintiff was not confirmed. Given the rationality and justice, the amount of non-pecuniary damage was also awarded by the court in a reduced amount (the decision of the Mias City Court of the Chelyabinsk Region in case No. 2-787/2011). Another frequent type of dispute is the recovery of earnings during the delay in issuing a work book. In accordance with Art. 84.1 of the Labor Code of the Russian Federation, the final calculation and issuance of a work book should be held on the last day of the employee. In accordance with Art. 234 of the Labor Code of the Russian Federation, the employer is obliged to compensate him for the unlawful earnings in all cases of illegal deprivation of his ability to work. Such an obligation, in particular, occurs if the earnings were not obtained as a result of a delay in the employer to issue an employee of the work book or the wording of the reason for the dismissal of the employee was entered into the work book. So, in the situation considered below, the court twice determined the consistent periods of the collection of wages during the delay in issuing the work book. Arbitrage practice. The employee filed a lawsuit against the educational institution with a claim for the recovery of compensation for the delay in issuing a work book. In the substantiation of the claim, he indicated that the decision of the justice of the peace was satisfied with his requirements for the employer to recover wages, compensation for the delay in issuing a work book and compensation for non -pecuniary damage. However, to date, the defendant has not given him a work book, in connection with which the plaintiff filed a lawsuit with a claim for the recovery of earnings during the delay in issuing a work book calculated for a new period. The defendant presented written evidence about the direction of the plaintiff of the work book. In this regard, the court satisfied the claims partially, having determined the period for which compensation for the delay in issuing the work book (the decision of the Kirovsky District Court of St. Petersburg) is recovered. Practice shows that refusals to employees to satisfy the requirements for the payment of wages upon dismissal are most often connected, firstly, using the consequences of passing the deadline for applying to the court with the stated requirements (Article 392 of the Labor Code of the Russian Federation), and secondly, with the establishment of the establishment of Incorrect calculation of the employee (in this case, the requirements are subject to partial satisfaction). The recovery of weekends and compensations upon dismissal among disputes to recover weekend benefits are the most popular are disputes about the recovery of a weekend benefit upon dismissal to reduce the number or states, and liquidate the organization. The disputes on the recovery of the output benefit during the reduction or liquidation of the organization are disputes about the recovery of compensation upon dismissal by agreement of the parties, especially between the employer and his top management. The conflicts of this category are far from always ending in the complete satisfaction of the requirements of the employee. In almost half the cases, the court refuses them to recover. Arbitrage practice. The employee applied to the employer with a lawsuit to recover compensation upon dismissal. In the justification of the lawsuit, she indicated that she worked as the director of the direction, the employment contract with her was terminated by agreement of the parties. According to the contract, the payment of the weekend was provided. However, this payment by the employer was not made upon dismissal. The court established the illegitimacy of the document specified by the plaintiff - the basis for the payment of the output benefit. Based on the provisions of the local acts of the enterprise, as well as the norms of the Federal Law of 08.02.1998 N 14-ФЗ “On Limited Liability Companies”, the court concluded that the general director, having signed a disputed agreement with the plaintiff, exceeded his authority in terms of disposal of monetary The means of the company, in connection with which the court recognized the court in this paragraph unlawful. On the basis of the foregoing, the court refused the plaintiff to satisfy the claims (the decision of the Kirovsky District Court of Krasnoyarsk dated 08.22.2011). In these cases, refusals to employees to satisfy the requirements for the recovery of weekends and compensation are related to: - the lack of the right to compensation and the output allowance upon dismissal; - the illegality of establishing an increased size of the output manual; - the illegality of the document - the grounds for payment; - the lack of grounds for recovering a weekend or compensation. Tips for the employer How to do the employer if there is a dispute about the collection of wages? We offer the following algorithm of actions: 1. Find out the issue of the availability of grounds for the employee to apply to the court. If these reasons are undeniable, we recommend that you decide on the settlement of the dispute peacefully. 2. When establishing the controversy of the issue, prepare for the consideration of the case in court: to submit documents requested by the court (including an employment contract, orders for admission, transfers and dismissal, documents on wages and other evidence). To study judicial practice on similar types of disputes and with similar source data. 3. Ensure the presence of the representative of the employer in court. Practice shows that, with rare exceptions, the complete refusal of the employer of physical presence at the court sessions reduces his chances of a positive consideration of the dispute. At any outcome of events in the process of considering the case in court, the employer should not forget about the general right of the parties to the dispute to conclude a settlement agreement, which will take into account the interests of both the employee and the employer. Responsibility for non-payment of wages and yet court disputes are not the worst for the employer. Any dispute, even about the recovery of accrued, but not paid wages, may result in refusal to satisfy the requirements of the employee. The employer has a chance to uphold their interests. In relation to the possibility of bringing the employer to administrative responsibility, not everything is so simple. With the exception of cases of delay in prosecution, the employer for any established violations of the requirements of the legislation in terms of wages (untimely payment, payment is not fully, etc.), most likely will be held liable. Consider the case when the head of the enterprise was brought to administrative responsibility for non -payment of wages. Example. The prosecutor's office conducted an audit of the execution of labor legislation in the activities of an agricultural production cooperative. It was established that in violation of the requirements of Art. Art. 41, 136, 142 of the Labor Code of the Russian Federation, employees of the enterprise from March 2011 were not paid in full, in connection with which the enterprise formed debts in the amount of more than one million rubles. According to these facts, the district prosecutor against the director of the organization opened a case of an administrative offense under Part 1 of Art. 5.27 of the Administrative Code of the Russian Federation (violation of labor legislation and labor protection), according to the results of the consideration of which the employer was involved in a fine of one and a half thousand rubles. In addition, in the interests of citizens whose rights were not respected, applications were sent to the court to recover wage arrears, which the court was fully satisfied. At the same time, the legislation establishes not only material (interest payment under Article 236 of the Labor Code of the Russian Federation) and administrative (Article 5.27 of the Administrative Code of the Russian Federation), but also criminal (Article 145.1 of the Criminal Code of the Russian Federation) liability.

The debts remained with those fired. What to do?

Company accountants sometimes have to deal with situations where an employee quits, but still owes the company a certain amount of money. In these cases, the first question of interest is: what to do with the resulting debt of a resigned employee? The answers to this question are contained in our article.

All situations with debts of company employees can be divided into 2 groups. First. The employee is in the process of being fired, but it is already clear that the final settlement amount will not be enough to compensate for his debts to the company. Second. The employee has already quit and is no longer owed money, but his debt to the company remains outstanding. Let's look at both of these situations. Let us also consider the procedure for writing off and reflecting in accounting and tax accounting the amounts of various debts of dismissed employees.

Main types of debts of laid-off workers

The reasons for employee debts to the employer vary. But the main thing is that the employee has the right to terminate the employment contract with the company at any time on his own initiative. In this case, it is enough for the employee to notify the employer in writing 2 weeks before the day of his dismissal. On the last day of work, the manager is obliged to issue such an employee a work book and make final payments to him 1.

In this case, the employee may have debts to the company. But the employer has no right to delay the issuance of the work book and the final payment amount.

There are different types of debts laid off workers owe to companies. In practice, the following types of debts of dismissed employees are most often encountered:

- salary receivables resulting from a cash advance issued to an employee that was not fully worked out by him;

- the debt of the resigned employee for the accountable amounts issued to him;

- the employee’s debt for a loan not repaid in a timely manner;

- debt of a resigned employee for unworked vacation days.

Debt repayment methods

How to eliminate an employee's debt to the company? There are several main ways to get rid of such debt:

- deduction of the amount of debt from the final payment amount of the resigning employee;

- voluntary return of debt by the employee to the employer;

- collection of debts of a dismissed employee in court;

- debt forgiveness.

These methods can be used individually or in combination. You can deduct the debt of the resigning employee from the final payment amount. This is possible if the final settlement amount is greater than the amount of the accumulated debt. It must be borne in mind that in most situations, except for cases of full financial liability, an employee can indisputably be brought only to limited financial liability, that is, he bears such liability within the limits of his average monthly earnings 2. But if an employee resigns, then more than 20 percent of the amount due to him upon dismissal cannot be withheld from him, since the final payment is a one-time payment 3 . It should also be taken into account that labor legislation strictly defines cases in which an employer can withhold an employee’s debts to the company from the salary of a resigning employee 4 . In addition, such deductions can be made only if the employee does not dispute the grounds and amounts of deductions 5 . In this case, the employee's written consent to such deductions should be obtained 6 .

This is interesting: The statute of limitations under Article 228 is 2021

Example

The company's accountant made the following entries:

DEBIT 70 CREDIT 68 – 4810 rub. — personal income tax is withheld from the final payment amount;

DEBIT 70 CREDIT 73 – 6438 rub. — the amount of debt on accountable amounts is withheld;

DEBIT 50 CREDIT 73 – 5562 rub. - the company’s cash desk received a sum of money voluntarily contributed by Nikolaev N.K.

Collection by court