In accordance with current legislation, property is inherited in two ways: by will and in order of priority. In the first case, the inheritance is transferred to persons who were chosen by the testator during his lifetime, and, accordingly, are indicated in a special document - a will. If it is not available, then the property passes to the heirs depending on the degree of relationship in relation to the deceased. The list of relevant categories of relatives is established by the norms of civil legislation.

However, it should be noted that certain disputes often arise between heirs regarding the distribution of the inheritance. These contradictions are resolved exclusively in court. However, you should only have time to go to court within a certain period of time. If it is missed, the right to consider the dispute is terminated.

The legislative framework

The statute of limitations begins when a citizen learns that he is entitled to an inheritance or should have known about it. The period is 3 years. If the heir did not know about the inheritance matter at that time, this does not mean that his right to the testator’s property is lost. Regardless of the period of application, the heir who has valid reasons for his absence has the right to a part of the inheritance. The reasons for his absence must be documented.

In the Code of Civil Procedure Art. 196 introduced an amendment to the statute of limitations, according to which the limitation period is limited to 10 years.

What nuances to pay attention to when determining the limitation period?

The statute of limitations for inheritance legal relations begins to run after the opening of the inheritance, i.e. they are counted unambiguously after the death of the testator. If the plaintiff learned about the violation of his rights not on the day the inheritance was opened, but later, the countdown begins from that moment.

But when determining the beginning of the flow, there are still a lot of nuances. I’ll tell you about them further.

From what moment is the term calculated for violation of the rights of minors and incompetents?

The beginning of its course is the day when I learned (should have known) about the violation of the rights of a minor or incapacitated heir and about the proper defendant in the claim:

- His legal representative.

- Conscientious representative - in case the legal representative improperly performed his powers.

- The heir himself - subject to the emergence or restoration of full legal capacity.

On a note. The Supreme Court of the Russian Federation concluded: “A child, due to his age, cannot understand the importance of the requirements established by law, and the inaction of his mother/father/guardian should not affect the interests of the minor.”

How to determine the statute of limitations for challenging a will

To challenge/invalidate the will, from the moment it was announced or from the day the plaintiff learned (should have known) about the circumstances for invalidating the transaction, the following deadlines apply:

- For voidable wills, i.e. committed under the influence of delusion, deception, violence, threat and if the competent testator did not understand the significance of his actions and could not direct them - 1 year.

- For claims related to the consequences of recognizing a contested will as invalid, incl. return of everything received - 1 year.

- For void wills made in violation of the requirements of the Civil Code of the Russian Federation regarding the identity of the testator, the procedure for drawing up, the form, content, and certification - 3 years.

- For claims related to the consequences of declaring a void will invalid, incl. distribution of the testator's property among the heirs according to the law - 3 years.

Related articles:

How to challenge a will in 2021 - step-by-step instructions

What you need to know about the limitation period for real estate inherited by law and by will

For inheritance disputes, the subject of which is real estate (land plots, houses, apartments, dachas, buildings and structures), the general limitation period is most often applied - 3 years. For good reasons, this period can be extended, but it is unacceptable to exceed 10 years from the date of violation of the right.

For real estate, all the rules set out in the previous sections for calculating and applying the limitation period apply. Also pay attention to some nuances:

- Its course does not depend on the basis of inheritance, i.e. it does not matter whether the property has passed or should pass to you by law or by will.

- It depends on the requirements stated in the claim - a general period of 3 years or a special one can be applied (for example, for declaring a contested will invalid - 1 year).

- Does not apply to the requirements listed in Art. 208 of the Civil Code of the Russian Federation, incl. to a statement of claim by the owner or other holder of real estate to eliminate any violations of his rights.

- There is no statute of limitations if the claim is not related to deprivation of possession of real estate, but only a registered right is disputed.

- For claims for recognition of ownership rights aimed at ensuring that the right arose for the first time for the plaintiff (i.e., the plaintiff is not the owner of the property), a general period of 3 years applies.

- It is applied by the court only upon the application of a party to the dispute.

What is the statute of limitations for claims for division of property and allotment of shares?

If the heirs fail to reach an agreement on the method and conditions for dividing the common property or allocating a share to them, they have the right to go to court. The limitation period applies only if the rights of the heir are violated or if there are obstacles to their implementation.

Thus, statute of limitations does not apply to demands for the allocation of a share - inheritance rights have already been realized, and the impossibility of allocating a share due to a missed deadline would mean a limitation of the rights of the owners.

If, as a result of the division, one of the heirs received more property than the size of their allotted share, the discrepancy is eliminated not by reviewing the share in court, but by compensation.

On a note. When dividing inherited property, the heir can use his preemptive right to indivisible things, household furnishings and household items. But this should be done within 3 years from the date of opening of the inheritance, since later he will be deprived of this right.

If the dispute concerns illegally hidden or not included in the estate, the general period is 3 years from the day the plaintiff learned about the violation of the right and about the defendant in the case.

What is the deadline for allocating the marital share through the court?

The statute of limitations does not apply to cases involving the allocation of a marital share in property jointly acquired with the testator and the recognition of ownership of this share by the surviving spouse. This requirement relates to requirements to eliminate violations of rights not related to deprivation of possession under Art. 208 Civil Code of the Russian Federation.

On a note. The joint ownership regime applies to all property acquired during marriage, even if it was registered in the name of one of the spouses or if one of the spouses did not have their own income for good reasons (for example, running a household).

If the marriage was dissolved and after the divorce the property was not divided, then the general limitation period of 3 years applies to claims for the division of common property. The starting point will not be the date of termination of the marriage relationship, but the day when the surviving spouse learned (should have) learned about the violation of his right.

What is the limitation period for collecting debts of the testator from his heirs?

This period is calculated according to the general rule and is 3 years not from the date of death of the testator, but from the moment the delay occurred. It is not subject to interruption, suspension or restoration - Art. 1175 of the Civil Code of the Russian Federation.

The arrears of alimony and payment of penalties arising due to the fault of the testator are transferred to the successor who accepted the inheritance, within the value of the inherited property transferred to him - clause 10 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 4. The limitation period is calculated separately for each overdue monthly payment.

Important! If you, being an heir and acting as a defendant in the case of collecting the debts of the testator, do not declare in court that the statute of limitations has expired, the court is obliged to consider the claim, and most likely you will have to pay for the inherited obligations.

The limitation period does not apply to claims against heirs for compensation for damage caused by the testator to the life or health of another person, as well as for moral damage caused.

Concept and purpose

The transfer of rights to the property of the deceased is carried out on the basis of his will or by law if there is no will. The law prescribes a specific algorithm for the distribution of inheritance by kinship.

According to the law, relatives have the right to inherit property; they are divided by law into categories according to the degree of relationship in relation to the testator. According to the will, anyone can receive the inheritance.

There is a special category of citizens who receive a mandatory share of the inheritance upon acceptance, regardless of whether they are mentioned in the will or not. We are talking about the children of the deceased: marital, illegitimate, recognized and unrecognized (if the fact of paternity is documented). The transfer of property is carried out by a notary between the participants in the notarial case who have officially declared themselves.

After the death of the testator, relatives claiming property rights write applications to be recognized as heirs. Within 6 months, the notary reviews the inheritance case, if necessary, requesting additional documents confirming the family relationship with the deceased.

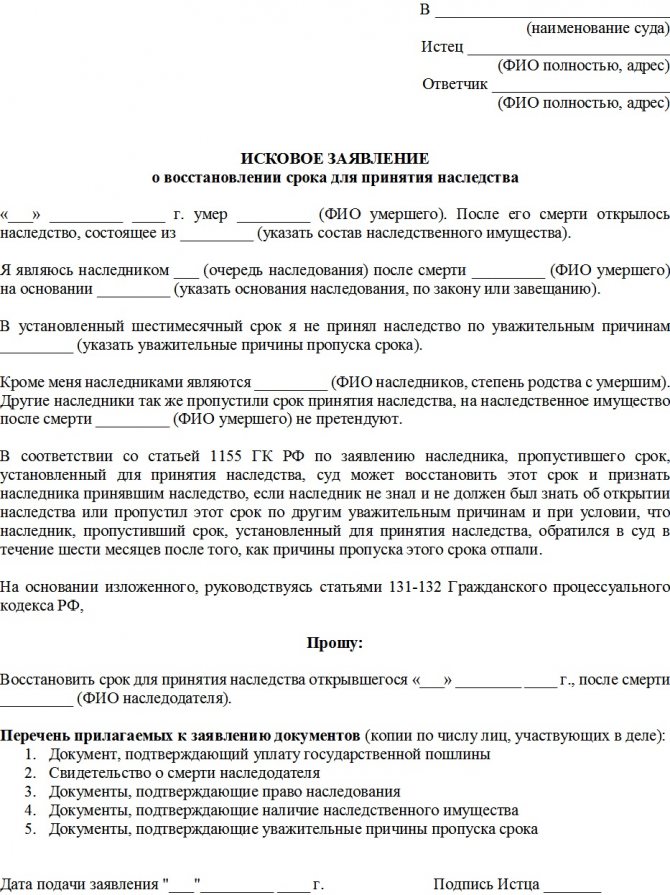

Filing a claim for restoration of a missed deadline

The claim is filed in court at the place of last residence of the deceased (place of opening of the inheritance case). In the application, the citizen must indicate the following information:

- full name of the judicial authority;

- information about the plaintiff;

- information about the defendant (in this case, the remaining heirs are indicated in this column);

- contact number.

The text of the statement of claim contains the following information:

- Date of registration of the document on the death of the testator.

- Reasons for the applicant’s absence from the notary within the period established by law.

- Grounds for challenging a testamentary document.

- Links to legal norms confirming the applicant’s rights.

- Signature, date.

- An appendix indicating the list of attached papers (including documents confirming that the statute of limitations has been missed).

After examining all the materials, the court makes a decision to satisfy the claim or deny it.

The statute of limitations is often used in inheritance cases. If it is missed, the applicant for receiving the inheritance must restore it in court by filing a statement of claim.

Your rating of the article

During what period can property be accepted by law and by will?

After the applicants have submitted applications to take possession of the property of the deceased, the notary begins the inheritance case. Its essence is to legally distribute property between heirs. To do this, for 6 months the notary examines the documents provided and examines whether there are any applicants who have not declared themselves. If the validity of the heirs' claims is confirmed, a certificate of the right to inheritance is issued six months later.

The law allows for the concept of actual entry into inheritance (Article 1153). The legality of the action is confirmed by the facts:

- Use of personal funds to maintain the property of the deceased.

- Payment by the heir of the testator's debts.

- Protection of the testator's property from encroachment by other persons.

The decision to enter into inheritance is made in court.

The distribution of property between legal heirs must be carried out within 6 months. After the expiration of the period, with a certificate in hand, they can register the property in their name.

If after 6 months an heir appears who has not declared himself for a good reason in due time, then the issue of redistribution of shares is resolved in court.

Duration of the will

How long does a will last during the life of the testator?

This type of document is not limited by law in terms of its validity. The will of the deceased is relevant even several years after death.

The testator can draw up several versions of the last will, and only the one that was registered last before death is considered relevant. Even if they are written sequentially, fixed in turn, but not canceled, each subsequent document is capable of canceling the content of the previous one.

When only one will is drawn up and registered, it will be valid until the death of the testator.

The testator has the authority to disinherit a specific relative, indicating him as an unworthy successor. Then this person will not receive anything even according to the law. On the other hand, the testator can include a citizen excluded from inheritance by a court decision. After this, his foundations for acquiring the inheritance will be restored.

It is possible to limit the time of acceptance of the inheritance by the testator himself, who is free to indicate a certain period of time and specific recipients of the property.

Testamentary papers are recognized as valid indefinitely, with the exception of their preparation under moral or physical pressure, as well as the incapacity of the now deceased, or the use of potent drugs.

Validity of a will after the death of the testator

The validity period of a completed will after the death of the testator is not limited by law. The fact is that the six-month period for fixing the right of succession begins not from the day of repose, but from the moment the testator contacts the notary.

When the successors in title are unaware of the death of a relative, the time period is not counted. The calculation will begin at the moment the will is opened with an employee of the notary's office. Then there will be only 6 months left to acquire heritage rights and obtain a certificate of ownership.

If the heirs did not know that a will had been drawn up, the law provides an additional 3 years for challenging the inheritance in order to restore the terms of acceptance of the deceased’s property.

Although this situation is called period restoration, in reality nothing is rehabilitated. A court decision may provide a basis for succession of heritage. Also, the judge has the right to cancel other certificates, if the issue has already been made, to redistribute shares between successors, in accordance with the wishes of the testator. The writ of execution is a justification for succession and there is no longer any need to go to a notary to register the right. You can immediately submit papers to register ownership.

Recognition of a completed will as a document subject to challenge is limited in time; only 12 months are granted.

And the assessment of the last will of the testator as void, its cancellation, can be done no later than 3 years from the date of expiration of the six-month period.

For an apartment

The validity period of a testamentary document for real estate in the form of an apartment is unlimited. It is possible to enter into inheritance rights on the basis of a will, even if the death of the testator occurred decades after its preparation. However, do not confuse the validity period of the document with the period allotted for filing an application for the right of inheritance. You should take care of entering into an inheritance as quickly as possible. If no one claims rights to the apartment, it becomes the property of the state. This outcome may also lead to litigation, during which it will be necessary to prove rights to property on the basis of an existing will. Taking into account all the above difficulties, the heir himself is interested in taking over the rights of the inheritance as early as possible.

On house

The drawing up and entry into force of a will for a house is carried out taking into account the same rules. It also does not have a validity period, but can be declared voidable or void in court.

Factors that force recovery

The heir is not deprived of the right to receive a share of the property of a deceased relative if he does not appear before the notary in due time to declare his rights. Restoration of rights can be achieved through the court by writing a statement of claim and submitting documents confirming that its absence was caused by good reasons.

Certificates of acceptance of inheritance that have been issued are invalid. The entire inheritance mass is distributed anew, taking into account the emergence of another applicant.

The legislation does not provide an exact list of factors by which it is possible to restore rights, but during the consideration process the court may satisfy the claim if there are good reasons:

- It was not possible to obtain information about the death of a relative.

- Lack of information about inheritance.

- Long-term illness, stay in a coma.

- Living in another country.

- Staying in places of detention.

Regardless of the reasons for the absence of heirs, the court considers each specific case subject to the provision of accompanying evidence in the form of official certificates, confirmations, eyewitness accounts and other things.

What does entering into an inheritance actually mean, read the article “How the procedure for actually entering into an inheritance is carried out.” Is it possible to refuse an inheritance? The answer is here.

How to restore a missed deadline

In practice, restoring the missed deadline within which, according to the law, it is possible to challenge a will, is not an easy matter even for an experienced lawyer. To do this, you need to provide the most compelling reasons for the judge to make a decision in favor of the plaintiff.

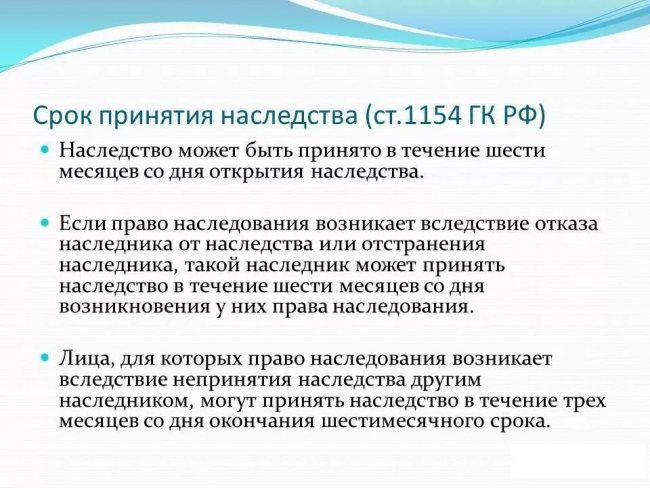

Article 1154 of the Civil Code of the Russian Federation establishes a six-month period for the heir to enter into his property rights. The testator must submit an application to the notary, all the while proving that he values this property, takes measures to preserve it, and pays maintenance costs. Then there should be no problems with inheritance.

If the testator did not know about the death of the testator and because of this missed the deadline for entering into the inheritance, then he needs to file an application with the court to restore the deadline, since there may be other relatives who knew about the death of the testator, and after six months they can claim to receive an inheritance. Or the state will receive the inheritance as escheat.

In order for the heir under the will to prove in court that the deadlines for entering into the inheritance were missed for serious reasons, it is necessary to collect a package of documents , including testimony of witnesses, a registration certificate, etc. But if there was no communication at all between the testator and the heir for a long time, then it will be very difficult to prove anything and the court may not restore the missed deadlines.

There are two ways to restore missed deadlines - through the court and without it . If all the heirs who accepted the property after the deadline for the heir to enter into inheritance under the will had missed, agreed to restore the deadline on their own, then a court decision will not be needed. Otherwise, you need to go to court with a claim to restore the deadline for accepting the inheritance.

How is the statute of limitations for inheritance calculated?

According to the law, the statute of limitations for an inheritance case is at least 3 years and should not exceed 10. Calculation begins with the opening of an inheritance case. It opens the day after the death of a citizen or after the fact of his death is established in court. The fact of death is established by the court, for example, if a person goes missing.

The beginning of the calculation is made in cases where the testator has left a will, all claimants to the property have been notified of the death of a relative and have written statements stating that they are claiming their share.

After reviewing the inheritance documents within six months, all confirmed heirs receive their share of the property.

Those who did not manage to meet the deadline have the opportunity to sue their part of the property, since the legislation, having determined the limitation period for inheritance, made it possible for the heirs to receive what was bequeathed to them or due by law.

Counting order

The limitation period is calculated from 2 positions:

- From the moment when the heir learns or should receive information about the right to a share in the inheritance.

- From the day of the death of a relative.

The notary opening the inheritance case must find out whether all the heirs have been found and notified of the death of the testator. If at least one of the applicants is not notified, the statute of limitations begins to count for him. The limitation period is calculated continuously, unless force majeure occurs. The Civil Code stipulates the possibility of interruption, suspension and renewal of the term.

Force majeure situations include, for example, those when a citizen cannot defend his rights while being seriously ill. As soon as the obstacles disappear, the statute of limitations continues to run. In the final calculation, time periods with obstructive situations are cut out. The presence of all obstacles must be documented.

Minimum period and maximum limitation

Citizens often confuse two concepts: the period for accepting the property of the deceased by right of inheritance and the statute of limitations. It is necessary to distinguish between them, since, despite the fact that they are interrelated, the limitation of periods is established to achieve different goals. Acceptance of an inheritance within 6 months implies the period of entry into inheritance.

6 months is enough time to document the relationship with the deceased. If he left a will, this simplifies the procedure for entering into an inheritance, since the will of the testator is the basis for the distribution of the inheritance.

The statute of limitations for inheritance means the possibility of “late” applicants entering into the inheritance.

The limitation period has time periods: 3 years - minimum, 10 years - maximum periods for citizens who, for objective reasons, did not have the opportunity to declare themselves immediately after the death of a relative.

When can the statute of limitations be extended?

Not every recipient of property by inheritance can change the limitation period. It will take powerful arguments that will convince the judge of the legality of the plaintiff’s demands.

There is no precise indication of the situations that are considered acceptable for changing the statute of limitations.

Based on examples of judicial practice, the following reasons are identified:

- the potential heir lived in another state for a long time and was not notified of the death of the testator;

- the citizen was not officially notified of the possible right of inheritance within the time limits established by law;

- the cause was a health condition (comatose state, severe illness);

- long business trip to another city or country;

- the citizen served in the ranks of the Russian Army;

- the heir served his sentence in prison.

If a citizen files a statement of claim, he must indicate a valid reason in it. In order for the case to be considered in court, supporting documentation must be provided.

Subsequently, the court will notify the applicant of the time of the hearing and of the extension of the statute of limitations under the will.

The following documents can be considered evidence:

- certificate from the military registration and enlistment office;

- a document confirming that the citizen has lived in the territory of another state for a long time;

- medical report from a doctor;

- a certificate from work to confirm the fact of a long business trip;

- document from the correctional service.

The application to the court must include the following information:

- the time when the applicant learned about the death of the testator;

- valid reasons for the absence of the plaintiff at the time of the death of the testator;

- justification of the reasons why the plaintiff did not previously present his inheritance rights;

- grounds for changing the statute of limitations for inheritance;

- links to current legislation.

When drawing up and submitting such documentation, it is advisable to consult with an experienced lawyer to ensure that all necessary papers are completed correctly.

The legislation establishes a maximum period during which interested parties can present their rights. It will be 10 years from the date of death of the citizen.

Notification of the opening of an inheritance is handled by a notary , and he cannot always notify all existing heirs. The latter, in turn, cannot influence this situation.

Based on Art. 1072 of the Civil Code of the Russian Federation, it is permissible to restore the limitation period, and the plaintiff is classified as an heir under the following conditions:

- objective reasons for missing deadlines are given;

- a strong evidence base is presented;

- the applicant applied for judicial assistance no later than six months after he learned about the possible receipt of the inheritance.

If necessary, the judge will hear testimony from witnesses. If the court satisfies the claims, then all documents issued earlier are automatically invalidated. The property is considered a common estate.

After recognizing the applicant as an heir, the court sets the size of the shares for each of the successors.

The will is drawn up by a notary at the place of residence of the testator. It will not be difficult for his possible heirs to find out about the fact of drawing up a will. In the absence of such a document, the property of the deceased is distributed according to the law .

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, contact specialists through the online form .

If the allotted time is missed

The Civil Code stipulates a long period for the emergence of new claimants to the property of the deceased. There are times when these deadlines may be missed. A person who learns about an inheritance cannot immediately appear to declare his rights for objective reasons. The legislation allows the resolution of the inheritance issue in court, even if the time provided by the Civil Code has been lost.

When can the court extend the period?

A citizen who learns that he is entitled to an inheritance, after the expiration of the 10-year period established by law, can file a lawsuit in order to prove that his rights have been violated.

Such applications are considered by the court in a special procedure. The judge to whom the case is transferred checks the compliance of the format of the application and its content with legislative norms, and the composition of the attached documents. If no claims arise against them, he sets a date for consideration of the case.

At the same time, a request is made to the notary office where the inheritance case was formed. This is necessary to ensure completeness of information on the essence of the issue under consideration.

During the process, the circumstances due to which the heir did not declare himself and the reasons that prompted him to do so are clarified. Only the court determines the true validity of the applicant's arguments. If they are found to be valid, the inheritance case is subject to review, regardless of how many years have passed since the death of the testator.

How to restore the right

Based on Article 1072 of the Civil Code, the court restores the missed limitation periods and adds the citizen to the list of heirs if the following conditions are met:

- The deadline was missed for objective reasons.

- There is an evidence base in the form of documents confirming the rightness of the applicant.

- The citizen filed a claim no later than six months after he learned that he was entitled to an inheritance or after the reasons that prevented him from filing the claim had disappeared.

All certificates of ownership of the testator’s property issued earlier are canceled, and the distributed property again becomes the common inheritance mass. The court determines measures to protect the newly-minted heir and includes him among the legal successors.

The only condition for a fair judicial verdict is a solid evidence base explaining the reasons for the citizen’s absence when opening an inheritance case.

Having recognized the right of the new heir, the court re-determines the shares due to each. There are many nuances to the distribution of property after restoration. For example, if there were no heirs other than him at any level, then all the property went to the state. In this case, the defendant is the local municipality. He is obliged to return to the citizen the property due to him.

Why you need a certificate of inheritance, read the article “How to draw up and receive a certificate of inheritance.” Find out how to search for an inheritance here.

Where to contact

After the death of a citizen, heirs can find out whether he left a will on the distribution of his property. An official will is drawn up in a notary's office at the place of residence of citizens, so the heirs can easily find out about its contents from the notary. If the deceased relative did not have time to write it, then the property is distributed according to the law. The notary opens the inheritance case, and after 6 months, all heirs are issued a certificate of inheritance.

The authority that is called upon to resolve conflict issues between recipients of inheritance is the court.

A claim can be filed by:

- An heir who believes that his rights have been violated during the distribution of shares.

- Relatives who were not included in the will.

The court resolves all issues that the relatives were unable to resolve peacefully, acting on the basis of legislation and taking into account only real documents confirming the validity of the statements of the offended relatives.

Drawing up an application

Applications for restoration of the right to inheritance are considered by the district court. In the application, the citizen must describe the reasons why he did not attempt to declare his rights to inheritance in a timely manner.

Information that must be provided in the claim:

- The date of receipt of information about the death of the testator.

- About the reasons for the absence of a relative at the time of death.

- Reasons why the applicant did not claim the inheritance.

- What are the grounds for challenging a will?

- Links to articles of legislation according to which he has the right to challenge an inheritance case.

The plaintiff petitions to restore the statute of limitations from the moment he learned about the death of a relative or about the inheritance due to him. He prescribes a list of documents that he submits for consideration by the court. On their basis, the evidentiary basis of the claim is built.

It is preferable if a probate lawyer takes part in drawing up the claim. He will be able to correctly advise which legislative acts need to be referred to in a particular situation. The application must present only real facts that have become an obstacle for the plaintiff to participate in a timely manner in the procedure for distributing the inheritance.

Judicial process and procedure

An appeal to the court begins with writing an application to restore the statute of limitations, attaching documents confirming the facts stated in the claim. The application is registered in the court office, and from that moment it goes to the judge. He considers the correctness of the claim and the availability of all necessary documents. Having delved into the essence of the case regarding the restoration of terms in relation to the newly emerged heir, the judge sets a date for the trial.

The court requests an inheritance file, on the basis of which the declared heirs have received the official right to accept a share from the inheritance mass. The essence of the trial is to find out whose fault it was that the heir was not informed about the death of the testator or to confirm that there is significant evidence of his absence.

If there is insufficient documentary evidence, the court may call witnesses to the hearing. As a result, the court must decide on the legality of the citizen’s claims to a share in the property of the deceased or refuse to satisfy his claim. If the decision is positive, the heir’s further actions are to register the assigned share in Rosreestr and obtain a certificate of ownership legally. If the court does not consider the evidence provided sufficient for a positive verdict, the plaintiff can challenge its decision in a higher court.

What it is

After the death of a citizen, the right to property that belonged to him by right of ownership or right of lifelong inheritable ownership passes to his heirs. Their circle is determined by the presence or absence of a will.

Accordingly, the heirs have the obligation to declare their right to receive property in accordance with their shares. This requires contacting a notary at the place of residence of the deceased or at the location of most of his property. In this case, persons claiming inheritance must provide documents confirming this right.

Free legal consultation

+7 800 350-51-81

These usually include:

- death certificate of the testator;

- documents confirming relationship (birth certificates, marriage certificates, etc.).

Reference! If, in accordance with a court decision, a citizen was declared dead, then the notary, among other things, is presented with the corresponding decision of the judicial authority.

The responsibility of the notary includes checking the specified information, determining the full range of heirs, and sending relevant notifications to interested parties. In addition, in some cases, the notary is obliged to take measures aimed at protecting property from attacks.

It has been established that potential heirs must contact a notary within 6 months after the death of a citizen. This period is designated as the period for accepting the inheritance. If it is missed, then the corresponding rights must be established in court.

After the expiration of the six-month period, the notary issues certificates of inheritance to all identified heirs, which from that moment are considered accepted.

However, situations often arise when not all persons who, by virtue of law or a will, have the right to part of the inherited property, turn to a notary in a timely manner.

There can be quite a few reasons for this, among them it should be noted:

- untimely notification of a person about the opening of an inheritance and the need to receive it;

- serious illness;

- location outside the Russian Federation;

- being in a penitentiary institution.

The law allows such heirs to restore their violated rights and receive their due share. However, this can only be done by going to court. It should be understood that over time, property that was previously inherited may change owners, status, or be completely destroyed.

In this regard , the legislator has introduced certain restrictions related to the time period during which an interested person has the right to seek judicial protection of his rights. They are called statutes of limitations. Skipping them means it is impossible to file a claim in court demanding the allocation of part of the inheritance.

Thus, the statute of limitations for inheritance cases should be understood as a certain period during which a citizen who has the right to inheritance, but has not declared it in due time, can restore it in court.

Attention! The limitation period should be distinguished from the period for accepting an inheritance. The latter is directly related to the application to a notary and cannot exceed 6 months. The possibility of filing an application with the court remains for a much longer time.

It should be noted that going to court after the inheritance has been accepted by other heirs is possible only if there are good reasons for doing so. The appropriate degree is established by the court based on the specific circumstances of the case.

General entry period

In general, the current legislation is quite universal in this matter. Thus, the statute of limitations for most disputes that require judicial resolution is 3 years. This rule is established by Art. 196 of the Civil Code of the Russian Federation.

The same fully applies to disputes related to inheritance. The legislator introduced this rule based on the fact that this period is the most optimal from the point of view of the possibility of protecting one’s rights. Restoring this deadline if missed is quite problematic and is only possible if strong evidence of its validity is presented to the court.

Is there a limitation period?

If the three-year statute of limitations has been missed, but the interested party has presented compelling reasons that the reasons for this were valid, then the court has the right to restore it.

For example, this is possible if the plaintiff is seriously ill, when he was not notified of the death of the testator and was physically unable to apply for the inheritance in a timely manner or challenge the fact of its acceptance by the heir within a three-year period.

It should be noted that until recently (until 2013) there were no deadlines as such. In other words, a citizen, if there were good reasons, could apply for the restoration of deadlines at any time . However, this state of affairs significantly infringed on the rights and interests of both the heirs who accepted the inheritance in accordance with the established procedure and third parties.

For example , real estate could be sold, but if there was such an heir, the corresponding transaction was declared invalid, and therefore the bona fide purchasers of the property suffered significant damage.

In this regard, the legislator introduced a limitation period of 10 years. In practice, this means that ten years after the right of one of the heirs was violated, it is not possible to restore it even in court.

Special periods

The general limitation period for inheritance of real estate or other valuables applies in most cases, however, in some situations, special periods directly related to a particular situation may be applied.

- When restoring the deadline for accepting an inheritance - 6 months . It begins to flow from the moment when the circumstances that did not allow you to contact a notary earlier no longer exist.

- If the validity of the refusal of inheritance is contested – 1 year . The period begins to be calculated from the moment the will of the person is expressed.

What terms do the requirements not apply to?

In some cases, for some requirements, the rules on the application of limitation periods do not apply at all.

So, if a person actually accepted an inheritance (without turning to a notary, but used the property for its intended purpose), then he can go to court to establish this right at any time.

In addition, the statute of limitations does not apply to cases related to the establishment of kinship, which can be fundamentally important when deciding on the distribution of the inheritance.