Would you like to consult a lawyer for free? Write to the chat on the bottom right or call the hotline, calls within the Russian Federation are free. We accept questions any day of the week.

In the practice of labor and family law there is such a thing as maternity leave for men. Additional time to care for the child is provided to the father only if the mother is currently unable to raise the child. Read the procedure for registration in 2021, features and deadlines in this article.

general information

Maternity leave refers to the period of time during which relatives take care of and monitor the development of the child until he is 1.5 or 3 years old.

Whether a man can go on maternity leave depends on a number of rules:

- You can use the right to maternity leave only after taking rest due to pregnancy and childbirth.

- Only a close relative can apply for this type of vacation.

- If the person who has accepted the obligation to care for the baby is officially employed, then during the period of absence he retains his place of work and the amount of his salary.

- A citizen has the right to count on additional monetary compensation.

It should be remembered that an employer cannot refuse to provide a man with maternity leave. The main thing is to confirm that another relative did not take advantage of this right.

Payments to men caring for children

Allowance is financial assistance designed to make it easier to care for a child while on parental leave. Until children turn 1.5 years old, payments are made by the employer's accounting department in the amount of 40% of the employee's average monthly earnings.

It happens that a man combines two jobs at once, and his work experience in both places is more than 2 years. In such a situation, the benefit is paid for one place of work at the discretion of the employee. In some cases, benefits are assigned by the local department of social protection of the population.

Formula for calculating child care benefits based on the father’s salary:

SP = ZP * 24: (730(731) – PN) * 30.4 * 0.4 , where

- SP – benefit amount,

- Salary – salary,

- 24 – number of months in 2 previous years,

- 730 – number of days in 2 years, 731 – in case of a leap year,

- PN – periods of incapacity,

- 30.4 – average monthly number of days,

- 0.4 – 40% of the total amount.

If the amount of benefit calculated based on wages is less than the minimum value established by law, the minimum benefit is paid:

- 3065 rubles 69 kopecks (for the first child),

- 6131 rubles 37 kopecks (for the second child).

The minimum payment is usually assigned:

- persons caring for the baby when the natural parents are deprived of parental rights,

- when students are caring for a child,

- if the mother was fired due to the closure of the company during pregnancy.

It also happens that the benefit calculated based on the employee’s income exceeds the maximum established by law (23,089 rubles), then it is paid in the amount of 23,089 rubles, since otherwise the father’s total income exceeds the limit of the insurance base.

The legislative framework

Russian legislation regulates a man's maternity leave. The main source is the Labor Code of the Russian Federation, which in Art. 256 indicates the deadlines, as well as the list of persons who can receive time off to care for the baby.

Important! In Art. 255 of the Labor Code of the Russian Federation clearly states that sick leave due to childbirth and the birth of a baby is provided only to women; therefore, men cannot claim a similar benefit.

The current law No. 255-FZ (link – https://www.consultant.ru/document/cons_doc_LAW_64871/) regulates the right of a man who went on parental leave to obtain additional monetary compensation. And according to Art. 32 of Presidential Decree No. 1237, military personnel also have the right to receive maternity leave.

How to apply for the opportunity to work part-time?

According to current legislation, the father, like the mother, has the right, while on vacation, looking after the baby, to work on a part-time basis. This is stated in Art. 256 of the Labor Code of the Russian Federation.

Often this is the option preferred by most men who arrange child care. To do this, first take leave with benefits, and then additionally draw up an application for working, but on a part-time basis.

In this case, there is no need to obtain the consent of the manager..

In the application, the father must indicate how he intends to work:

- less than a week;

- how much time a day a person wants to work;

- shortened day (even by just 1 hour).

It is possible to choose the exact time when job duties will be performed.

It is worth noting here that a part-time work schedule represents work time whose duration is shorter than usual. The amount of the salary received in such conditions corresponds to that established in the employment contract. But it is recalculated based on the amount of time worked.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

When caring for a child, a parent can receive regular leave in the required amount during the year, interrupting the rest to look after the child. Upon completion, you can write an application to resume your vacation to look after your child.

Vacation up to 1.5 years

Lasts immediately after the end of maternity leave (B&P) and until one and a half years of childhood. For different women, the duration of this period can be of different lengths , depending on how many days according to the law she was entitled to maternity leave in the postpartum period - this is due to the peculiarities of the course of pregnancy and the nature of the birth.

In accordance with Art. 255 of the Labor Code for the recovery of a woman after childbirth provides for a postpartum period of leave under the BiR, amounting to:

- 70 days - during normal pregnancy;

- 86 days - in case of complications during childbirth (for example, if the mother had a cesarean section or birth trauma);

- 110 days - in case of multiple pregnancy (the birth of twins, triplets and more children).

Thus, in fact, this part of the maternity leave for employed women does not last a full year and a half, but 2-4 months less. This is significant, because on BI leave a woman receives a benefit in the amount of 100% of her average salary for each day on maternity sick leave, and after the end of maternity leave and the start of leave for up to 1.5 years, she is entitled to monthly payments of only 40% of this amount.

, compensation in the amount of 50 rubles also begins .

In addition to the traditional case of pregnancy and childbirth, women who adopt children :

- if at the time of entry into force of the court decision the child is under 3 months old, his mother is entitled to standard postnatal leave under the BIR (70 or 110 days for the adoption of 2 children or more);

- only after this the maternity leave period begins and benefits begin to accrue for up to 1.5 years.

Vacation up to 3 years

Unlike the previous part of parental leave, the period between 1.5 and 3 years can actually last a full year and a half at the request of the parents. In general, a woman will have to start work the day after her son or daughter turns 3 years old.

Due to objective financial difficulties at this stage of raising a child, many mothers prefer not to use the second part of the leave provided for by the Labor Code. This is permitted: maternity leave for up to 3 years can be interrupted early at any time convenient for the woman.

In this case, as a rule, the mother looks for a nursery for the baby and goes to work early. This option is not always possible due to queues in kindergartens and the insufficient number of nursery groups. Another common option is for parents to hire a nanny or give him up to his grandparents to raise.

This is important to know: How vacation days are calculated according to the labor code

Duration of maternity leave granted to men

According to the law, the duration of maternity leave is established in each individual case. It is important to adhere to the following rules:

- Vacation should not begin before the sick leave of the baby’s mother comes into force;

- The last day of vacation is when the child turns three years old.

An important rule is that a husband cannot go on maternity leave at the same time as his wife.

In practice, there are three options for registering maternity leave. Let's look at each:

- A man takes out parental leave for the entire period, starting from the expiration of his wife’s sick leave. This is possible in cases where a woman simultaneously goes to her workplace.

- The leave is divided into two parts: between mother and father in equal parts. Accordingly, a woman can take leave to care for a baby for up to 1.5 years. The man, in turn, applies for care leave from 1.5 to 3 years.

- Child leave is divided between the father and another relative, for example, a grandmother. Accordingly, a break from work for a man is documented with official documents, but for a grandmother it is not, since she is retired and can freely attend to her personal affairs.

It is precisely because of the multivariate nature of maternity leave that the terms vary in each individual case.

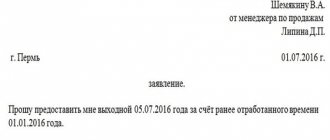

Application structure

In the upper right corner indicate the addressee of the application. Either the name of the employer (head of the organization), or the name of the territorial social protection body. It is necessary to indicate the full name, surname and patronymic of the author of the application, passport details and address of residence (registration).

Then write the heading in the middle: “application for parental leave and assignment of benefits.”

Next, there is a text with approximately the following content: “I ask for leave to care for one child under the age of one and a half years from January 25, 2021 to January 25, 2021” in the amount of 365 (three hundred sixty-five) days.” It is recommended to indicate the method of receiving benefits: cash or non-cash.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

After this, write down a list of documents, copies of which are provided along with the application. After the application, you must sign and date the application.

Registration procedure for men

Many people wonder how a man can go on maternity leave? The procedure for applying for maternity leave for any parent is the same and quite simple. The first step will be to collect all documentation. Among the main required papers are:

- A photocopy of the child's birth certificate;

- A certificate from the mother’s place of employment stating that she is not currently on maternity leave, which is drawn up in free form by the management of the organization;

- Application for parental leave.

Important! Even if the mother does not work, her husband has the right to apply for maternity leave, confirming with an appropriate certificate that the spouse does not receive social benefits.

An application on behalf of a man does not have a regulated form or official form, so it is also drawn up in free form. The following information must be provided:

- Business name;

- Full name of the manager, his position;

- Personal information about the applicant as an employee of the organization;

- Period of leave requested;

- Date of preparation of the paper;

- Signature.

The next step in registering maternity leave is the transfer of all papers to the employer. And this can be done in different ways:

- Come personally to the HR department and hand over a package of papers;

- Send all documents by registered mail with acknowledgment of receipt.

Having received all the documents, the employer is obliged to make a decision within 10 days to grant maternity leave to the young father. During this period, all documents are checked, an order is issued to grant maternity leave, as well as to assign financial benefits.

Period and main points when paying benefits to a man

In the Order you can also find information on how to obtain maternity leave. Payment must be made no later than the 26th of each month. Paragraph 43 establishes the right to receive benefits when performing duties under conditions of reduced working hours (part-time), carrying out activities at home, as well as continuing education. The grounds for payment are:

- decision of the head of the organization to grant an employee care leave,

- decision of the social protection department, which is located at the place of residence of the person caring for the child.

To begin the payment processing process, you must submit an application. The date of his acceptance is the starting point of the ten-day period for making a decision on the provision of benefits. In addition to the application, the following documents are required (a detailed list is contained in paragraph 54 of the Order):

This is important to know: Order to cancel vacation: sample 2021

- about the birth of a child or adoption - the original certificate and a copy,

- about the birth of previous children or adoption (if there are several children; original and copy of the certificate),

- a certificate from other employers (if part-time) or the social security authority (for the unemployed or students) stating that benefits are not issued for the specified child anywhere else (including the place of employment of another parent or relative),

- a certificate issued at the place of study and confirms the fact of full-time study.

When submitting an application, some employers ask you to draw up two different options: the first - until the child reaches the age of one year and six months, the second - for a period of time from one and a half to three years. This is due to the characteristics of the benefits provided. The fact is that from birth to one and a half years, responsibility for payments lies with the employer or the social security department, and the amount is equal to forty percent of average earnings. In its absence, calculations are made based on the minimum wage.

In addition to these payments, there is a second benefit (compensation), which is equal to fifty rubles. It is also paid by the employer or social security authorities for the period from birth to three years. To receive it, submit an application, a copy of the order for care leave and copies of the above certificates. Both benefits must be issued no later than six months after the child reaches the age mark of one and a half years.

When using leave, both for caregiving and other types, it is advisable to request a certified copy of the work record from the employer. When the market is unstable, companies often disappear, as do their leaders. A copy will help restore your lost work book.

Maternity leave for military personnel

For military personnel, maternity leave is provided in accordance with the above-mentioned Presidential Decree No. 1237. However, there is a main rule here: time off to care for children is provided only to women who are in military service. Men can apply for such relief in exceptional cases.

A man who is serving in military service has the right to apply for maternity leave for a period of no more than three months. Moreover, only in the following situations directly related to the mother:

- Died during childbirth;

- Undergoes long-term treatment in hospital;

- Convicted and in prison;

- She was deprived of parental rights.

Important! A father who is a military serviceman has the right to take short-term leave if he is recognized as the sole guardian of a minor (under 14 years old), as well as a child with a disability (under 16 years old).

If a man has taken maternity leave, then after 3 months he must go to military service. Extension of maternity leave is not permitted. The only way out is to stop performing military duties through dismissal.

How is work experience recorded?

The laws contain information according to which this period is included in several types of accounting at enterprises:

- By experience per specialty.

- Based on continuous work experience.

- Based on total work experience.

The position and salary are retained under any conditions. At the same time, there is the right to divide the period of three years into different parts. Whether the father can go on maternity leave during this period has already been discussed earlier.

Documents required for registration

In addition to the free-form application itself, the following attachments will be required:

- Civil statements from each parent;

- Certificate from the civil registry office in form 24-F;

- A certificate stating that the payment was not transferred to the spouse at the place of employment;

- Document on the birth of children (birth certificate).

The Social Security Service is responsible for payments at the place of residence if neither spouse has an official salary.

In order for the benefit to be paid, regulatory authorities will need the following information:

- Papers confirming that benefits were not paid before.

- Document with information regarding work experience.

- Civil IDs from each parent.

- Document from the registration department. Confirms cohabitation with the child.

- SNILS of all family members.

- Certificate in form 24-F about the birth of a baby.

- Application for maternity leave for men in Russia.

Amount of due payments

The list of possible material payments for men does not differ from those provided to women during maternity leave. Among them are:

- up to 40% of the average salary until the child reaches 1.5 years of age;

- 50 rubles is a fixed amount of money, which is paid from the first day of leave until the child reaches one and a half years old.

All funds received by the employee over the last two years (salary, bonuses) are taken into account. The exception is compensation and other material support.

Important! Today the maximum amount of monthly compensation is 23,120.66 rubles . Accordingly, when calculating 40% of the salary, the specified restrictions should be adhered to.

According to the latest data, financial benefits due to pregnancy and childbirth have their own minimum and maximum limits:

| Minimum payment in rubles. | Maximum payout in rubles. | |

| Normal birth | 43 615,65 | 282 106,70 |

| Complicated childbirth | 48 600,30 | 314 347,47 |

| Multiple pregnancy | 60 438,83 | 390 919,29 |

Additional funds are also provided when a man goes on maternity leave, regardless of who exercised this right - the child’s father or another relative. The calculation is made in the amount of 40% of average earnings. However, the minimum required by law must be adhered to:

- For the first child - 3788.33 rubles.

- For the second and subsequent children - 6284.65 rubles.

From February 1, 2021, at the birth of a baby, parents have the right to count on a one-time cash payment of RUB 16,759.09.

Can fathers go on maternity leave in Russia? On what terms

After the birth of a child, a woman has the right to take leave to care for a new family member. She is also entitled to additional payments from the social insurance fund.

For some time, such payments are compensated at the expense of the employer. For this, you have the right to apply for a tax deduction to compensate for part of the expenses. In connection with this direction, the following rules apply:

- 40% of the average salary is paid to a citizen during the first year and a half after the birth of a child.

- After this, the size of social payments is reduced, they will amount to only 50 rubles per month.

But other family members also have the right to take maternity leave. This applies not only to the father, but also to the grandparents. Therefore, the answer to the question of whether a man can go on maternity leave is positive.

One of the reasons for husbands to take maternity leave is, for example, the wife’s high salary. Sometimes it is simply useful for women to take breaks from maternity leave when returning to work.

Interesting. One of the mandatory conditions for resolving the issue is a written statement where the mother refuses the leave itself and the benefits associated with it. Both parents cannot use this opportunity at the same time.

When the father is on leave, the following rules apply:

- The period of maternity leave is included in the length of service.

- The place of work is retained.

Maternity leave can be used in full or in parts, depending on what is more convenient.

Fathers have the right to simultaneously receive leave benefits and work, but only part-time. In this case, the latter can be set at 7 hours.

Interesting fact! Even if the mother does not work, the father can go on maternity leave.

Maternity leave for an unemployed man or individual entrepreneur

Not only full-time employees performing their functions in the organization have the right to take maternity leave. This also includes: unemployed citizens, individual entrepreneurs, as well as notaries or lawyers who conduct private practice.

The only difference: a small amount of material benefits, since the funds come from the social protection budget. Accordingly, the calculation is made relative to the minimum wage. All other stages of registration are identical to regular employees, you just need to contact the local social security authority.

Difficulties may arise for an individual entrepreneur, since registration requires obtaining a number of additional documents. In particular, a certificate from the Social Insurance Fund confirming its absence from the register and other social benefits. If payments to the Social Insurance Fund were nevertheless made on behalf of the individual entrepreneur, then all documents and an application for maternity leave should be submitted to the social protection fund. Payments will be made from the fund of this organization (40% of the minimum wage).

Important! The benefit of taking maternity leave from an individual entrepreneur is that work is suspended during the rest period and there is no need for mandatory monthly insurance payments.

Conditions for parental leave in the case of fathers

The main condition, as in the case of regular leave, is that the leave is actually granted to a minor family member. The basis on which maternity leave is issued for the father is an application drawn up by the employee.

The right to leave arises if at least one of two certificates is provided by the wife:

- Confirmation that the citizen does not receive additional benefits.

- The fact that maternity leave has not been issued to the mother of the child.

Applications must be submitted in any form. After this, a corresponding Order is issued, which describes the maternity leave for men.

Deductions for purchasing an apartment and for mortgage interest

There are two property deductions: one is entitled to when purchasing an apartment, the other - if the apartment was purchased with a mortgage. Moreover, this does not have to be the same object. For example, you can get a “housing” deduction for one purchased apartment, and a “mortgage” deduction for another. Here you need to take a calculator and figure out what is more profitable.

Now, in 2021, the deduction limit when buying an apartment is 2 million rubles, which means that the maximum you can return is 260 thousand rubles (this is 13% of the limit). The deduction limit for interest paid on a mortgage is 3 million rubles; accordingly, the maximum you can return is 390 thousand rubles.

If, for example, an apartment costs 5 million rubles, then each spouse is entitled to a deduction of 2 million rubles. If an apartment costs 1.5 million rubles, everyone is entitled to a deduction of 1.5 million rubles. That is, if the cost of an apartment is less than the limit, it will be completely deducted from the tax base, and the remainder of the limit can be used on the next purchase. The situation is different with the mortgage interest deduction.

Both spouses can claim their right to a property deduction

, if they are officially married. This means that the maximum one family can receive:

2 * 260,000 + 2 * 390,000 = 1,300,000 rubles.

True, for this you need to earn a lot and pay personal income tax in the amount of this amount so that the state has something to return to you.

The right to property deductions, if it has arisen, does not disappear anywhere. If your family recently purchased an apartment, then the working spouse can immediately claim their right to a deduction. If you are on maternity leave, you can just wait for now. When you return to work, you will receive a deduction without any problems

- immediately from the employer or after a year of work according to the declaration. Moreover, even if you sell the apartment by then, you can still get a deduction.

You cannot transfer the right to your property deduction to your husband so that he receives double.

About the nuances of obtaining a property deduction, the dependence of the limit on the year of purchase of the apartment, transferring the balance of the deduction and transferring the balance of the limit, read in detail in our article: “How to get a tax deduction when buying an apartment.”

While you are on maternity leave, you can also receive property deductions if one of the following conditions is met.

- At the time of purchasing the apartment, you were still working, but went on maternity leave for a year.

Let's say you bought an apartment in 2021 and went on maternity leave on November 1, 2018. Then you can file a tax return for 2021 and receive a deduction for the months in which you worked, i.e. from January to October. You can receive the rest of the deduction when you start paying personal income tax.

- You are renting out real estate.

We wrote about this above. If you officially rent out the premises and pay taxes, you can submit a declaration and receive a deduction.

- You are an individual entrepreneur and apply the general tax regime.

If you pay personal income tax, submit a declaration and receive a deduction.

Calculation of benefits and some features

Previously it was indicated that the standard benefit amount is 40% of the average salary. But there are exceptions to this rule.

- Calculation based on the minimum wage, if the salary is below this indicator.

- 100% of the average earnings are always received by law enforcement officers, correctional services, and fire safety workers (firefighters).

For one person, regulatory authorities must assign at least 1,500 rubles. For each subsequent child in large families they should receive at least 3,000 rubles. Every year benefits in this direction are indexed.

24,536 rubles is the maximum benefit for citizens with fairly high earnings. Therefore, it is sometimes beneficial to take out maternity leave for the father to care for the child. Find out more about calculating maternity benefits.

Not only mothers, but also close relatives can go on parental leave. Time is used fully or partially. The order at the enterprise is issued after the man draws up a corresponding application indicating the exact timing of the vacation.

The right is preserved in relation not only to natural children, but also to adopted children taken under guardianship. The documents are issued for one of the spouses who will actually provide care. The father has the right to choose part-time leave. At the same time, the rest time itself is not reduced. A change in schedule is acceptable, after which work from home begins.

What are tax deductions and what are they?

A tax deduction is the portion of your income that the government allows you to avoid paying tax on. This kind of support from the state that you can get if you have children or spent money on something useful. Costs for purchasing housing, treating yourself and your relatives, and training are considered “useful.”

You can receive deductions from your employer or on your tax return. In the first case, 13% of the deduction amount due to you will be transferred by the employer not to the state budget, but to you as a salary increase. If you file a return, you will be refunded the due amount from the taxes you already paid last year.

Let's look at different types of deductions in the context of a “maternity” situation.